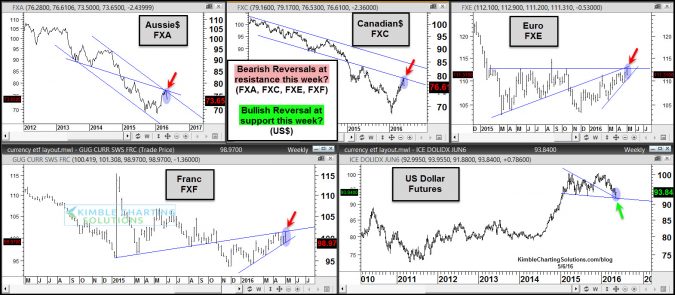

This 5-pack looks at the US$ and several currency ETF’s that seem to highly influence commodity prices

CLICK ON CHART TO ENLARGE

Last week the US$ was testing 1-year falling support above (lower right chart), where it might have created a bullish reversal pattern (bullish wick) at this support line. Let me make this clear, I am NOT saying that one week’s price action in the US$ makes a trend.

On the flip side, the Aussie$ (FXA), Canadian$ (FXC), Euro (FXE) and the Franc (FXF), might have created bearish reversal patterns (bearish wicks) at falling resistance lines (at the red arrows).

Commodities remain in a down trend over the past few years (lower highs and lower lows). What these “commodity sensitive currencies” do at falling resistance, will have a big impact on whether commodities can breakout of this trend over lower highs and lower lows. What King Dollar does at support, could have a big impact on Gold, Silver and Copper in the near future.

What FXA, FXC, FXF, FXE do at falling resistance, should give us a big clue to where commodities might be a couple of months from now. If they breakout, the CRB index could do well. In some ways, the world might “hope” these currencies breakout, to keep global deflation at bay.

–