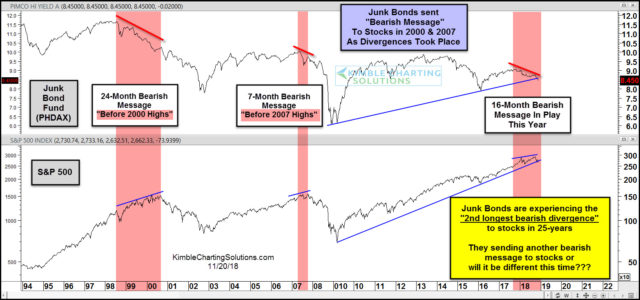

This chart looks at Junk Bond Fund (PHDAX) and the S&P 500 over the past 25-years. Junk bonds sent bearish messages “before stocks peaked in 2000 & 2007.” Bearish divergences took place for 24-months in 2000 and 7-months in 2007, prior to stocks peaking and turning much lower.

This year Junk bonds have been sending a bearish message to stocks for the past 16-months, as another bearish divergence has been taking place.

Junk bonds and the S&P 500 are currently testing 9-year rising support currently. If both break below 9-year support, they would be suggesting that a long-term low in stocks is not in play.

Junk Bonds sending an important message as they did in 2000 & 2007 or will it be different this time???

We have been sharing this message to members for over a year. If this type of divergence analysis would be of value to you, we would be honored if you were a member of our most popular research package.

–