Will the economy experience a “Demand Shock?” Consumers stay at home and don’t buy many items.

Will the economy experience a “Supply Shock?” Workers stay home and don’t create many products.

Will a combo of both take place or neither of these shocks unfold? I humbly don’t know the answers to these questions, they are above my pay grade.

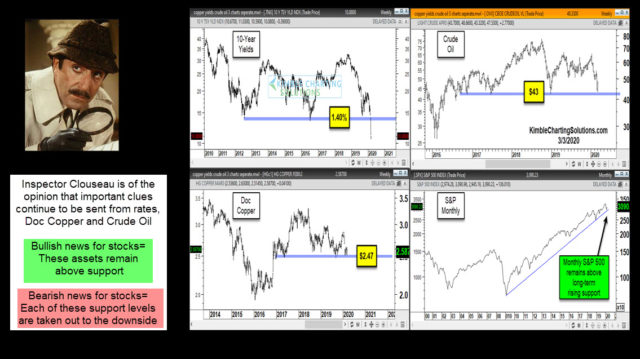

I am of the opinion that very important clues will be sent by the price action from current levels of Crude Oil, Doc Copper, Interest Rates and the S&P 500 on a monthly basis.

The Power of the Pattern today highlights that Crude Oil, Doc Copper and the S&P 500 have not broken below critical support levels at this time.

If Doc Copper breaks below the $2.40 level and Crude breaks below the $41 level, the odds increase the S&P 500 could break below monthly rising support.