by Chris Kimble | Sep 24, 2020 | Kimble Charting

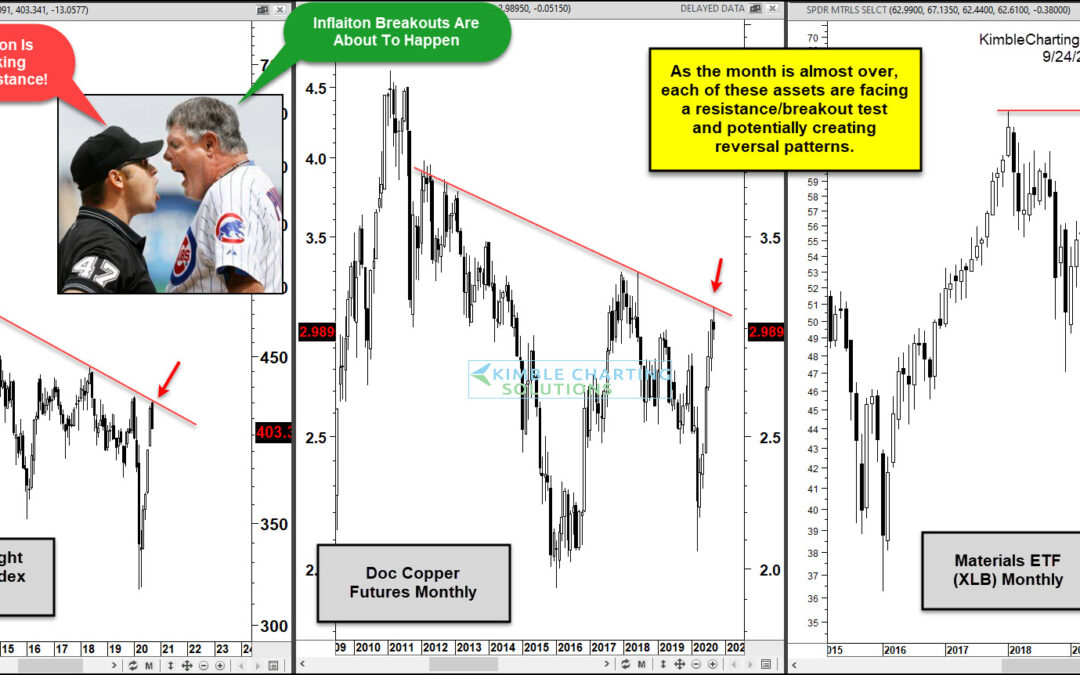

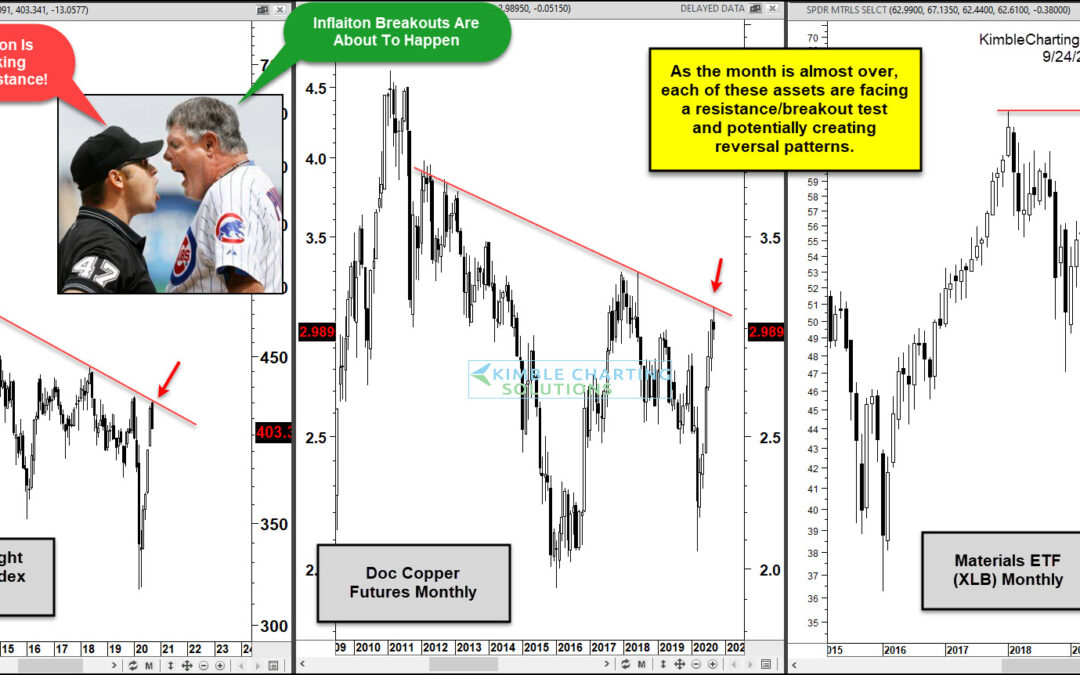

Inflation has long been a word that the Federal Reserve uses but the general markets have forgotten about. Why? Well because it’s been virtually non-existent for years. Key indicators like commodities (i.e. copper) have been in a down-trends and the Materials Sector...

by Chris Kimble | Sep 9, 2020 | Kimble Charting

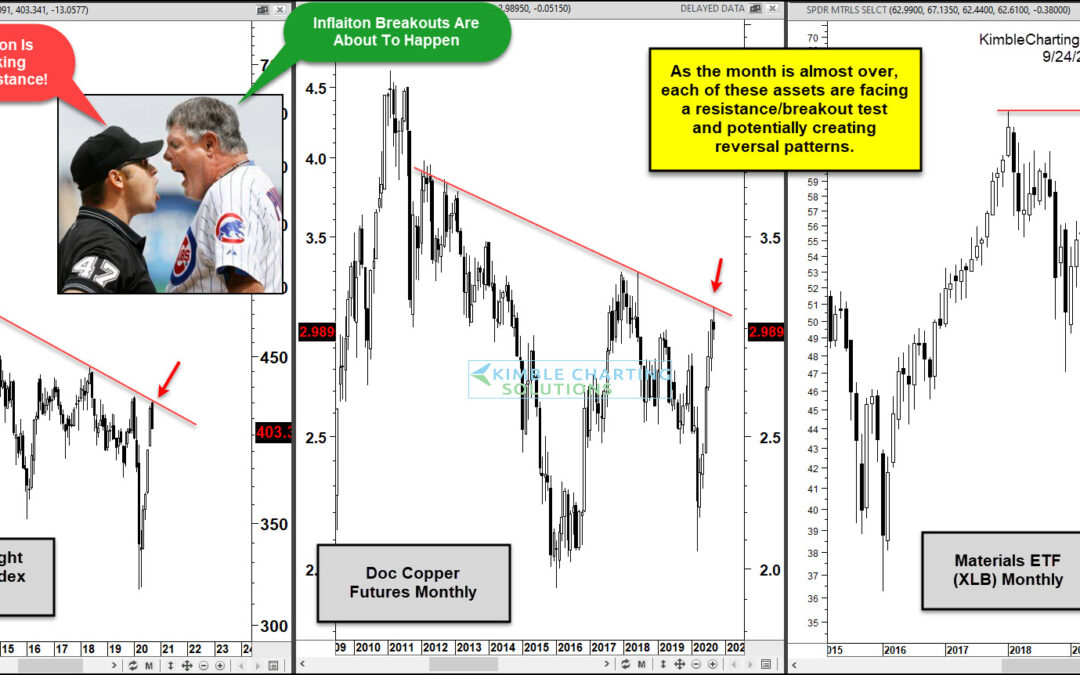

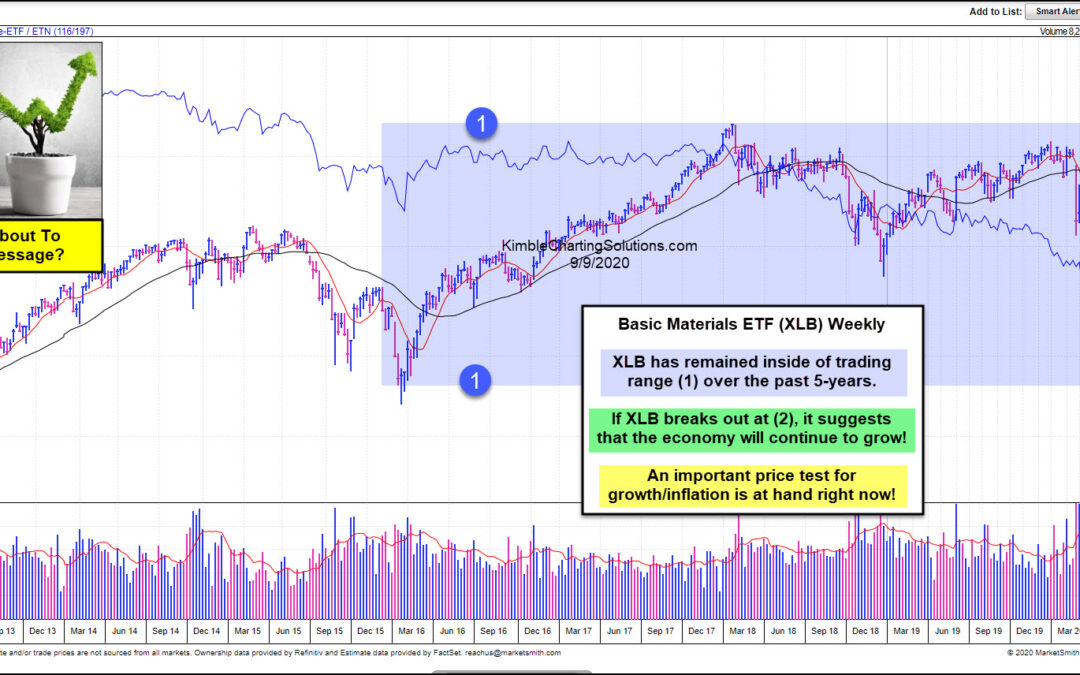

Are Basic Materials stocks about to suggest that the economy is about to grow/inflate? An important price test is in play for them that will go a long way to answering this question! The chart looks at Basic Materials ETF (XLB) from Marketsmith.com. The chart...

by Chris Kimble | Oct 5, 2017 | Kimble Charting

Many are of the opinion that what Doc Copper does, can send an important price message about the strength or of lack of in the overall economy. Doc Copper is important to keep a close eye and how Basic Materials stocks are performing can be important to keep aware of....

by Chris Kimble | Feb 3, 2017 | Kimble Charting

Since the election, it is easy to find talk about the prospect of future growth and spending, to spur on the economy going forward. Below looks at a couple of sectors that could go a long way in helping us determine if growth or lack of is about to take place. Below...

by Chris Kimble | Aug 26, 2016 | Kimble Charting

Basic Materials stocks can often times give a decent snap shot of how an economy is doing from a growth or lack of perspective. Below looks at Basic Materials ETF (IYM) over the past decade.CLICK ON CHART TO ENLARGEIYM remains inside of an upward sloping mult-year...

by Chris Kimble | Jan 22, 2014 | Kimble Charting

CLICK ON CHART TO ENLARGE Freeport McMoran (FCX) remains inside of a multi-year falling channel. After hitting falling resistance of last FCX is breaking support at (1) above. This usually isn’t a good sign for the Doc Copper of copper mining stocks as...

by Chris Kimble | Feb 25, 2013 | Kimble Charting

CLICK ON CHART TO ENLARGE Does it seem odd that Government Bonds could rally and stocks could decline for a while right now? Recently the Power of the Pattern suggested to Members to Long Government bonds and to take advantage of lower prices in the Basic materials...

by Chris Kimble | Oct 11, 2012 | Kimble Charting

CLICK ON CHART TO ENLARGE Basic Materials (IYM) has reflected relative weakness, compared to the S&P 500 for well over a year and a half, as it has underperformed the 500 index by 20%. Many are of the opinion softness in China has impacted this sector. When IYM...