by Chris Kimble | Jun 23, 2022 | Kimble Charting

We have covered the commodities rally and highlighted the everyday concerns with rising inflation and rising interest rates. Today, we’ll revisit some long-term charts of key commodities and discuss why we should be watching for potential topping formations. Below is...

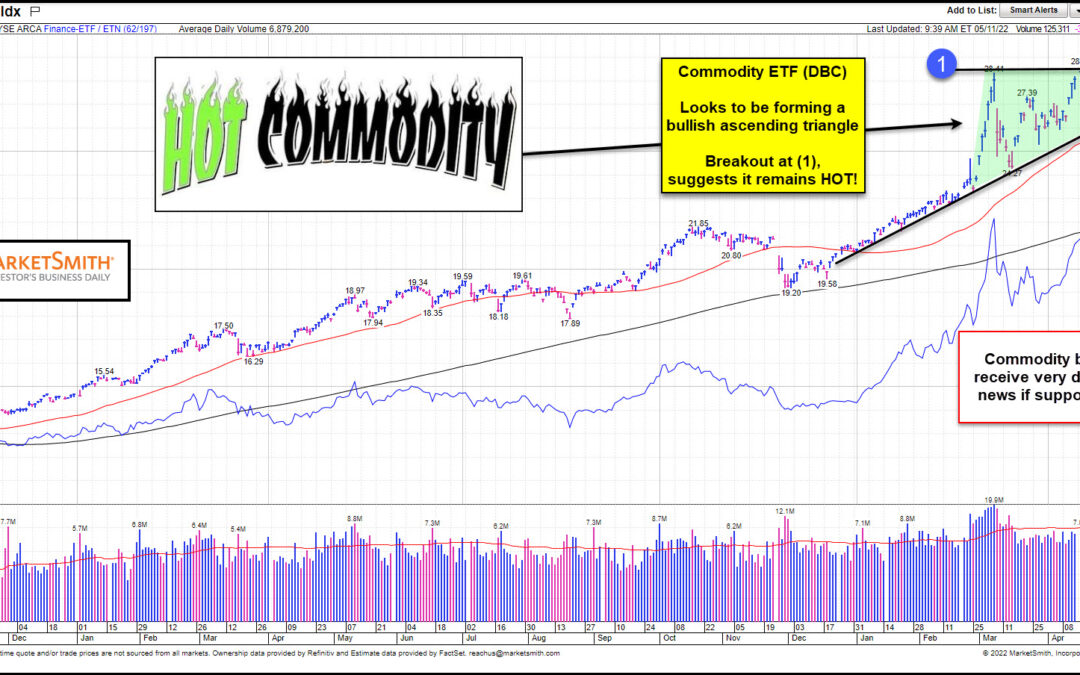

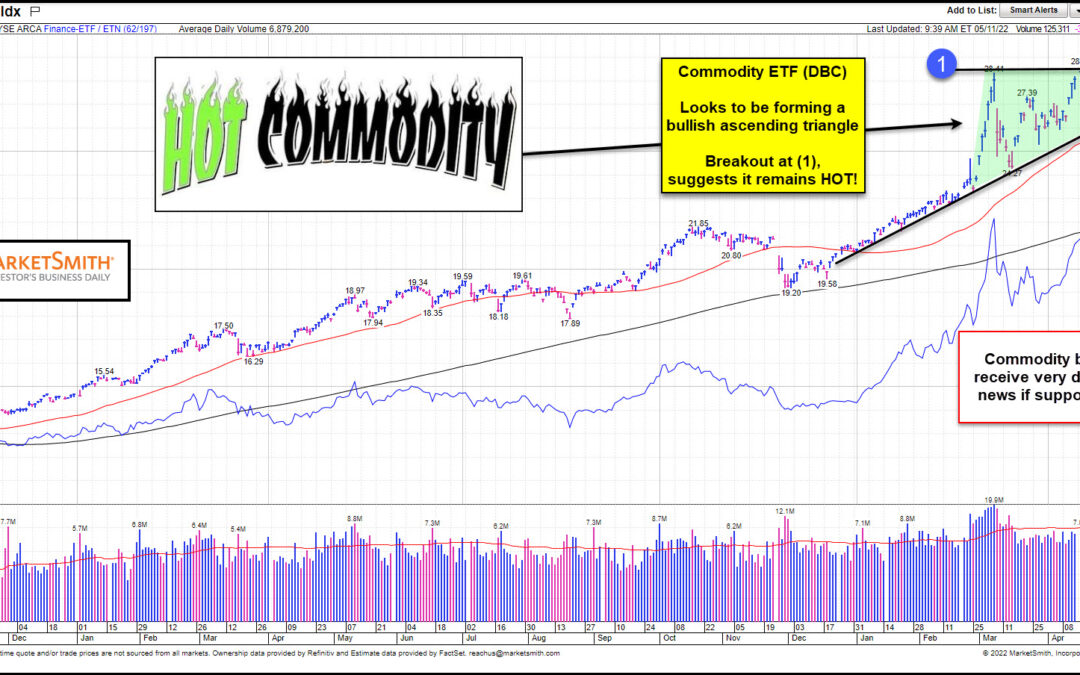

by Chris Kimble | May 12, 2022 | Kimble Charting

Commodities have been one of the few winners in 2022. But with elevated commodity prices, consumers are now left with an ugly dose of inflation on everyday costs (food, energy)… And with falling stock prices, they are getting a dose of deflation in their investment...

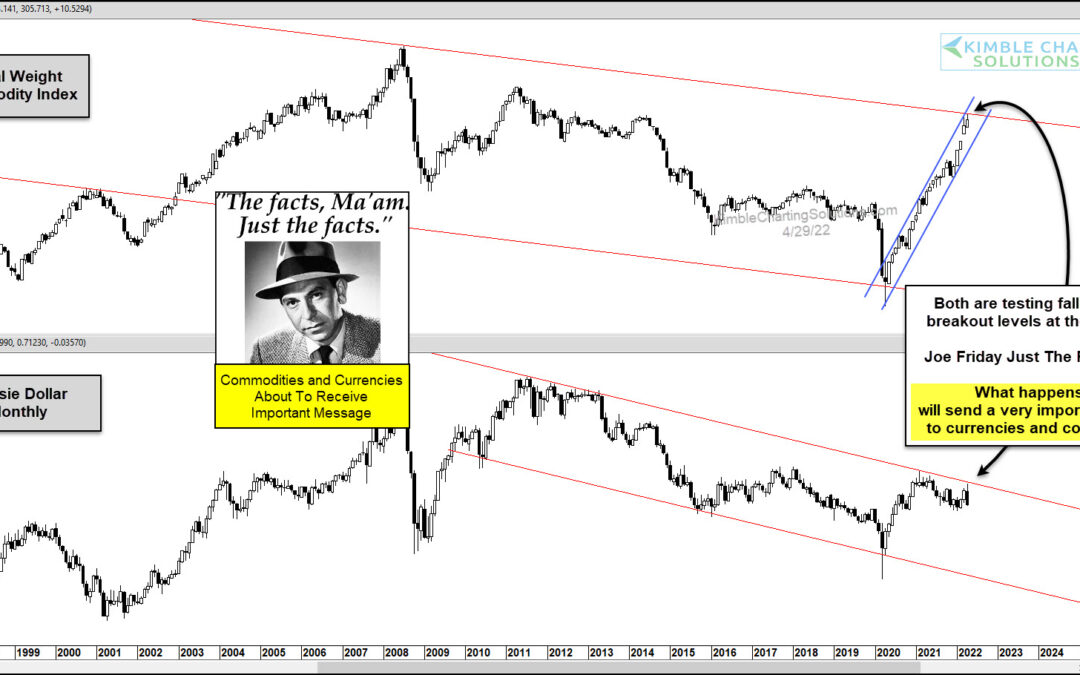

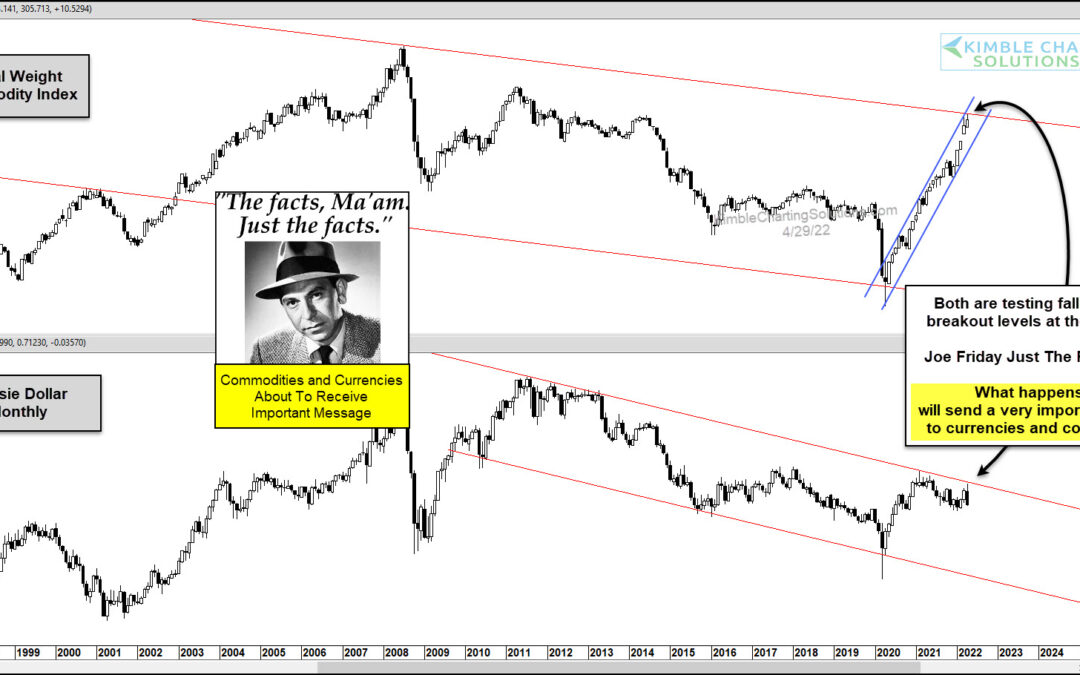

by Chris Kimble | Apr 29, 2022 | Kimble Charting

In the commodity-currency correlation department, commodity bulls know that a strong Australian Dollar is a tailwind for commodities. Today, we look at both – The Equal Weight Commodity Index and the Australian Dollar Currency – on “monthly” timeframes. And we turn to...

by Chris Kimble | Feb 25, 2022 | Kimble Charting

The CRB Commodity Index has rallied sharply over the past 2 years. And although the index is not near all-time highs, it is getting stretched into overbought extremes. One way to look at whether a security is trading near extreme levels is to check on its % above the...

by Chris Kimble | Nov 10, 2021 | Kimble Charting

From 1999 to 2009, equities under-performed commodities. This culminated with the ’08-’09 Financial Crisis. This was followed up by a 10+ year run of equities out-performance. Are the tables ready to turn yet again? Today’s chart looks at the ratio of the S&P 500...

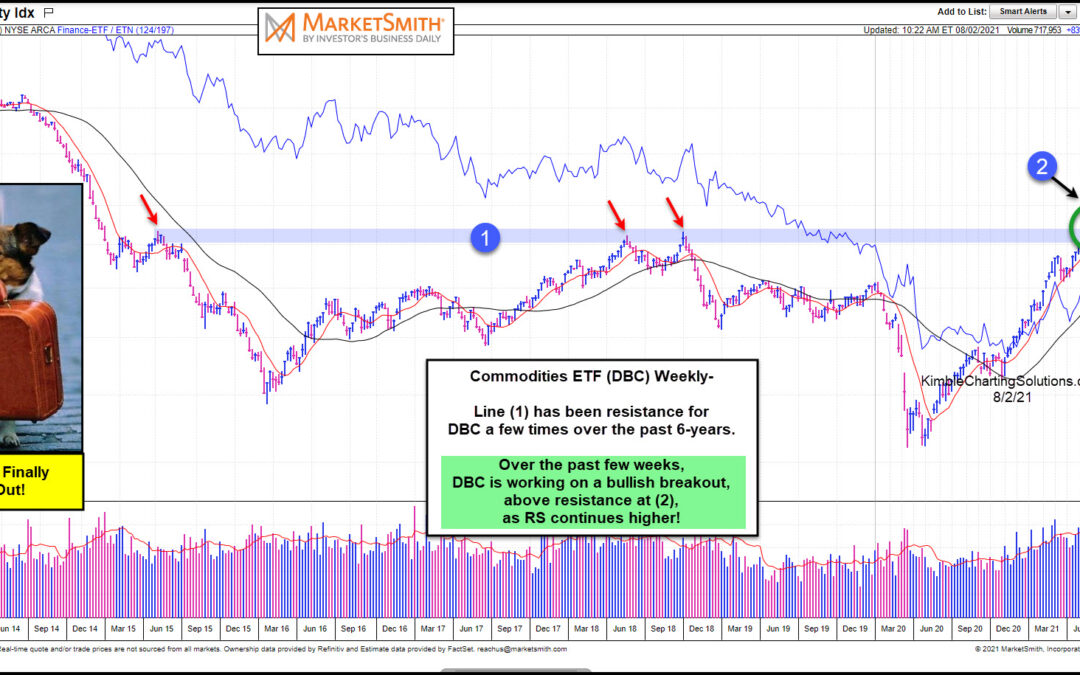

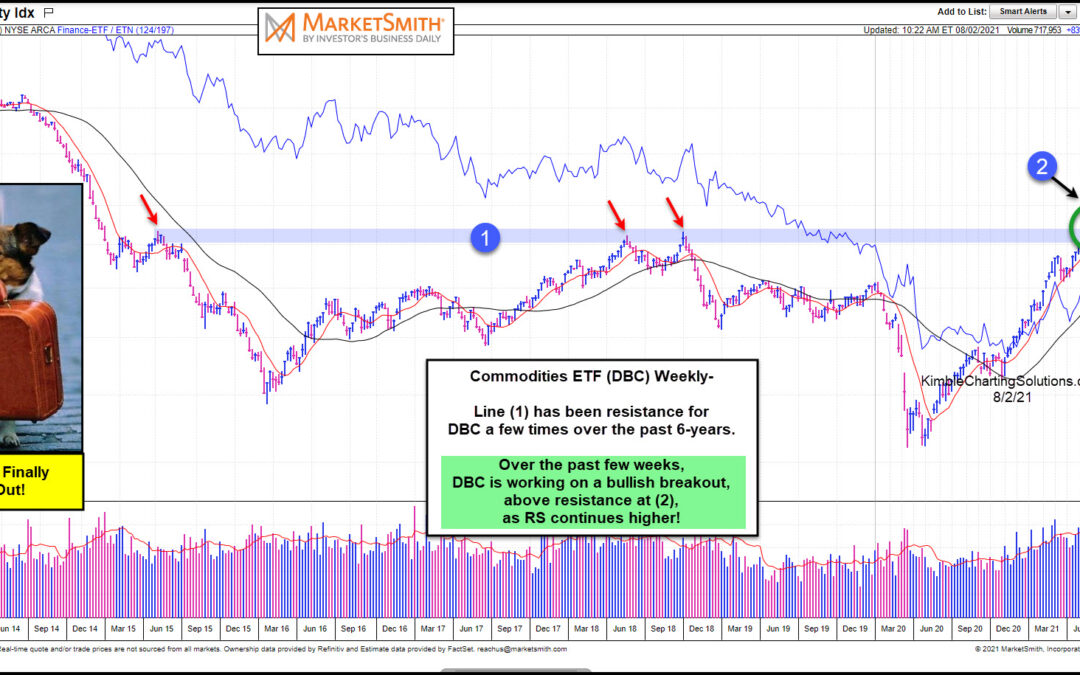

by Chris Kimble | Aug 3, 2021 | Kimble Charting

This chart was created at Marketsmith.com, where you can learn how to trade with the pros for three weeks for only $9.95 I have written a lot about select commodities and the potential for breakouts across the commodities industry. Recently, I have highlighted key...

by Chris Kimble | Jun 30, 2021 | Kimble Charting

Rewind to March 2020 and things weren’t looking so good for commodities. COVID-19 was in the news and several assets were trading sharply lower. Then came the comeback. And in a big way. Perhaps even concerning way when you fast forward to today. As you can see in...

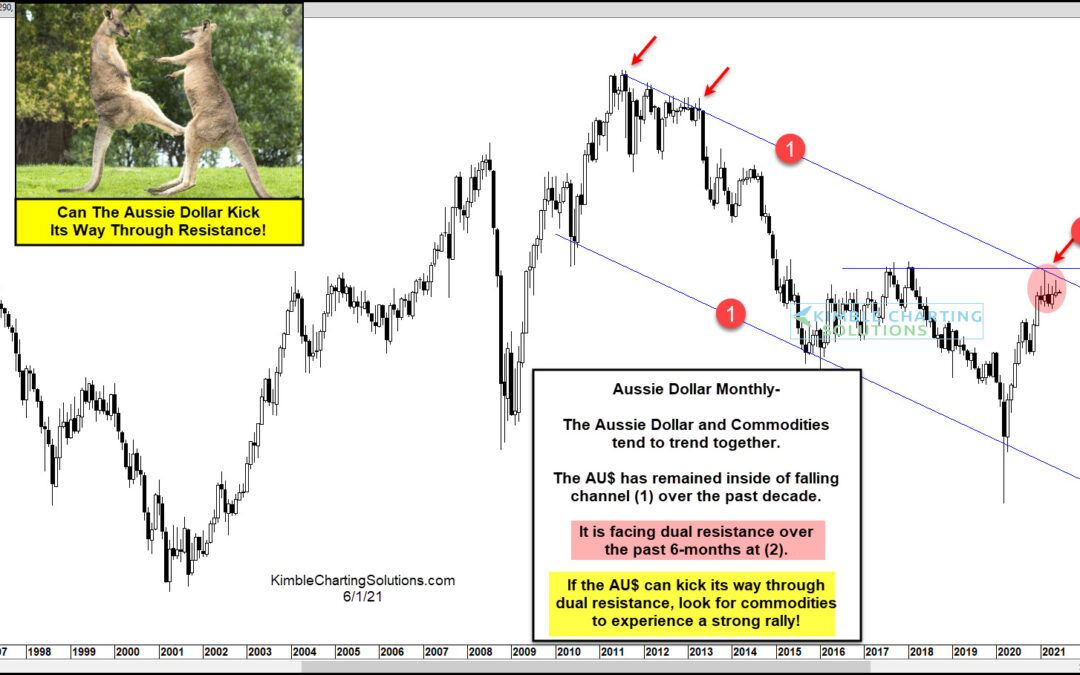

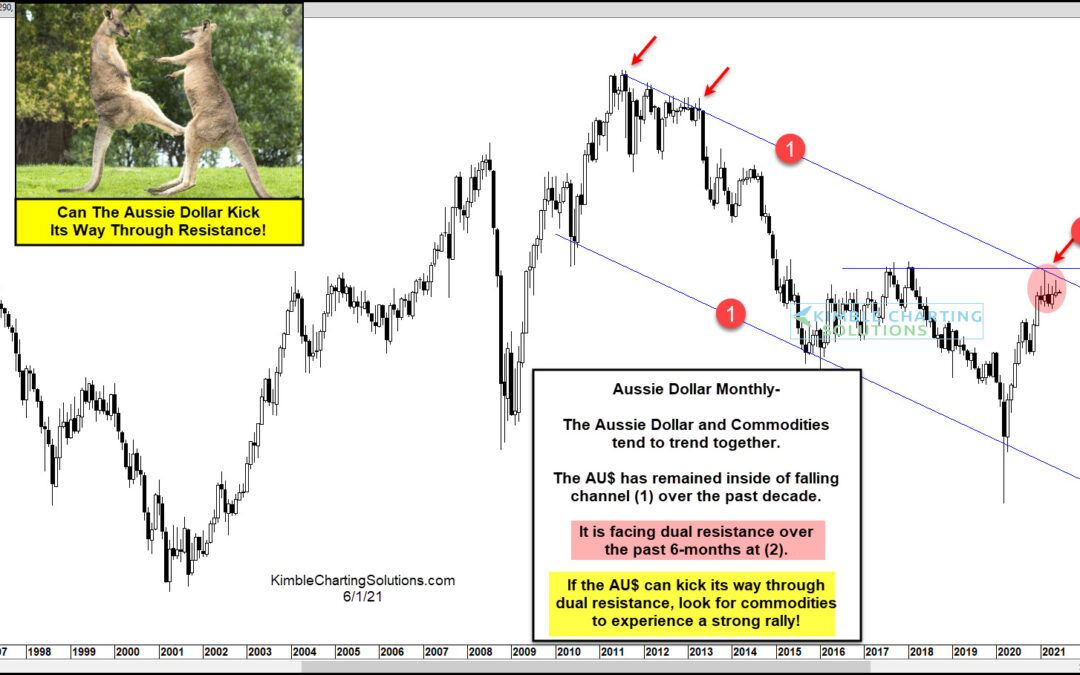

by Chris Kimble | Jun 2, 2021 | Kimble Charting

Early 2020 marked a 19 year low for the Australian Dollar (Aussie, AU$, etc…), but since that time the currency has been very strong. And, being that the Aussie Dollar and Commodities tend to trend together, this strength has carried over to the commodities market as...