by Chris Kimble | Apr 8, 2019 | Kimble Charting

The GDXJ/GDX (Junior/Senior Miners) Ratio can create meaningful reversal patterns and send important signals to the mining sector, at key inflection points. Did the ratio send an important signal to miners last week? Possible! The GDXJ/GDX ratio has traded sideways...

by Chris Kimble | Mar 4, 2019 | Kimble Charting

Precious metals have been a hot topic for investors and the financial markets. Gold, in particular, has caught the eye of market participants. After a 6 month rally into February, Gold futures reversed hard to the downside. This reversal came as gold prices tested...

by Chris Kimble | Jan 28, 2019 | Kimble Charting

Gold is testing a key inflection point that could determine where it is months and months from now! Gold has created a series of lower highs over the past 8-years just below line (A). The rally over the past 4-months has gold testing the underside of this falling...

by Chris Kimble | Jan 3, 2019 | Kimble Charting

Since the 2011 highs, Gold futures have created a series of lower highs and lower lows inside of falling channel (1). The rally since the lows in 2016 has Gold facing the top of its 8-year falling channel at (2). This test comes into play as resistance for Gold,...

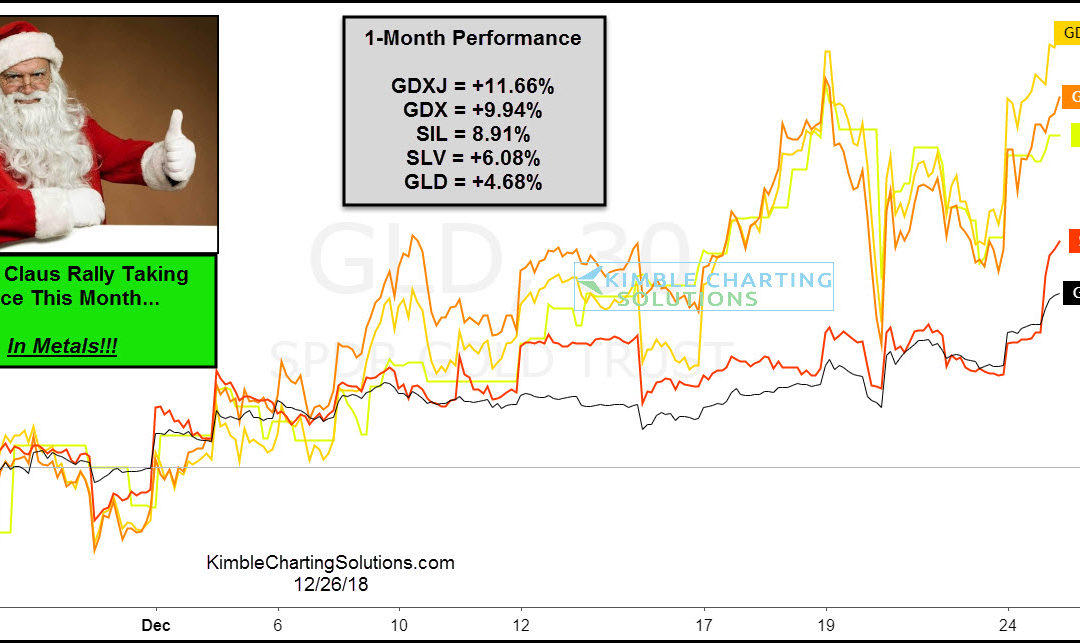

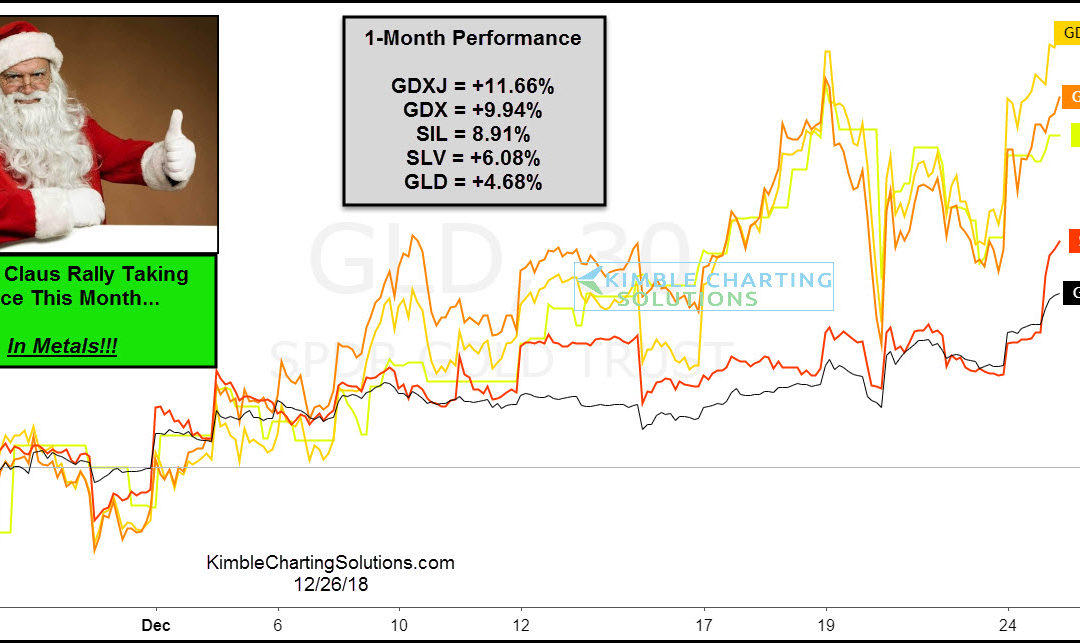

by Chris Kimble | Dec 26, 2018 | Kimble Charting

While it’s easy to find articles that suggest a Santa Claus rally isn’t taking place this year, the Power of the Patterns would disagree! This chart looks at the performance from several assets in the metals sector the past 30-days. Even though all of...

by Chris Kimble | Dec 12, 2018 | Kimble Charting

Silver miners (SIL) have had a rough 7-years, as the ETF finds itself nearly 75% below its 2011 highs. No doubt the long-term trend remains down. SIL is has declined 27% since the first of this year (See chart below), where it is testing a falling support line at (1),...

by Chris Kimble | Dec 3, 2018 | Kimble Charting

2018 has been rough on Gold Miners, as they’ve declined a large percentage. The decline has this key ratio testing dual support to start off the week. This chart looks at the GDXJ/GDX ratio (Junior Miners/Senior Miners) over the past 8-years. If you are bullish...

by Chris Kimble | Sep 17, 2018 | Kimble Charting

CLICK ON CHART TO ENLARGE The Junior Miners/Senior Miners Ratio (GDXJ/GDX) can often signal when key turning points are about to take place for Gold & Silver Miners. Above looks at this ratio, which highlights that a multi-year narrowing pennant pattern has been...