by Chris Kimble | Jul 13, 2023 | Kimble Charting

The precious metals complex may be ending a 2 month pullback / consolidation pattern. And perhaps in grand fashion! With Gold and Silver prices bouncing off key price support, we are seeing similar action in the Gold Mining stocks. Today, we look at a “weekly” chart...

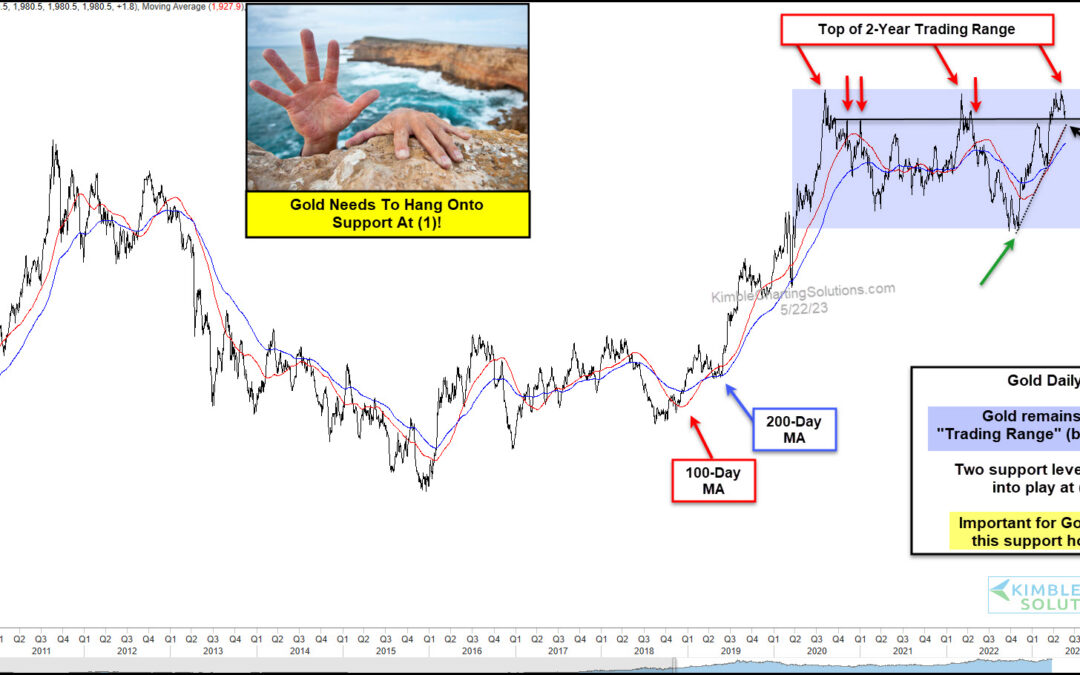

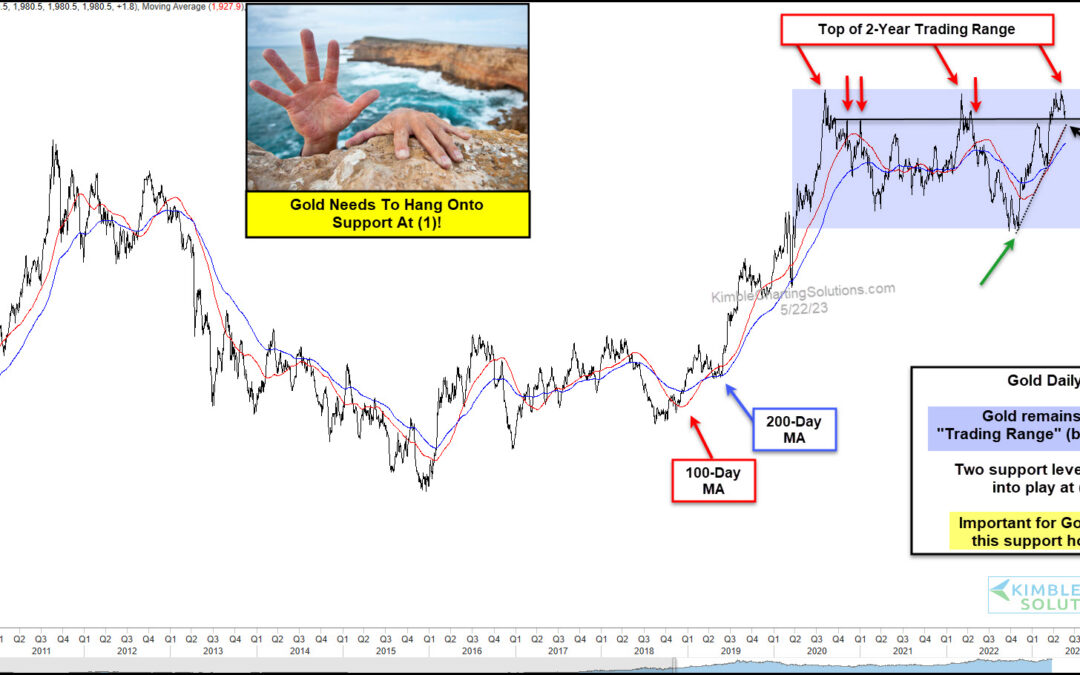

by Chris Kimble | May 24, 2023 | Kimble Charting

There’s so much uncertainty today that I think the markets are uncertain about being uncertain. I know Gold is sure trading like it. With so much uncertainty in the world today, it’s not surprising that Gold prices remain elevated. But each time it looks like a...

by Chris Kimble | May 20, 2022 | Kimble Charting

It’s been a rough past few weeks for the Gold Miners ETF (GDX). A bearish reversal in April has sent shares spiraling into May, down nearly 25%. Today’s “weekly” chart of the Gold Miners (GDX) from Marketsmith.com highlights this reversal, as well as important...

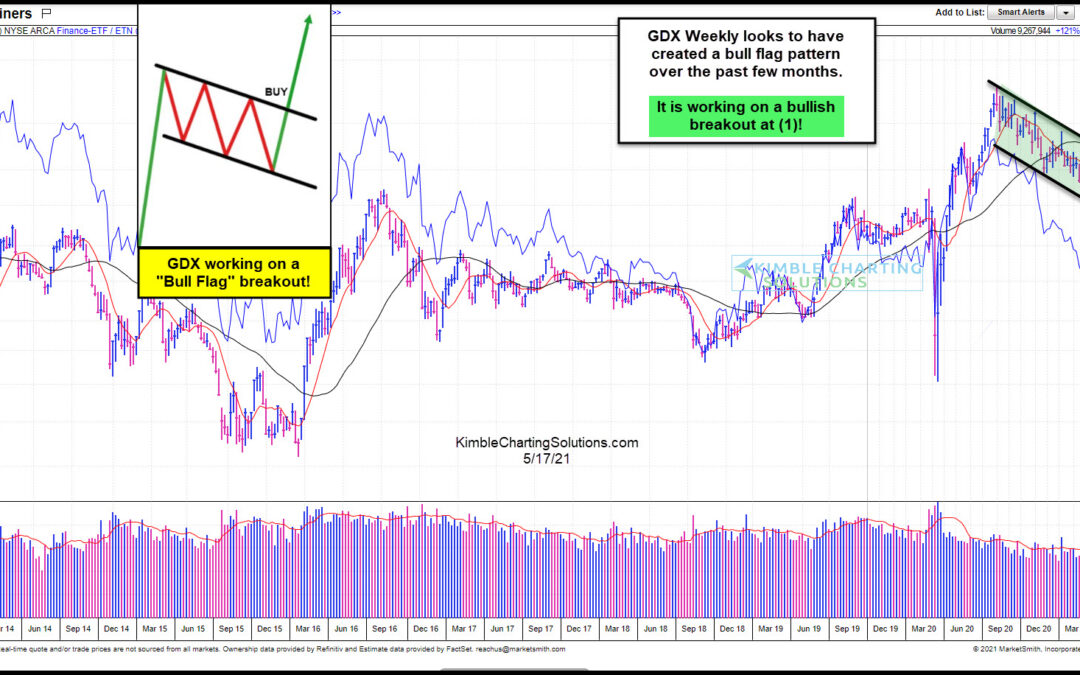

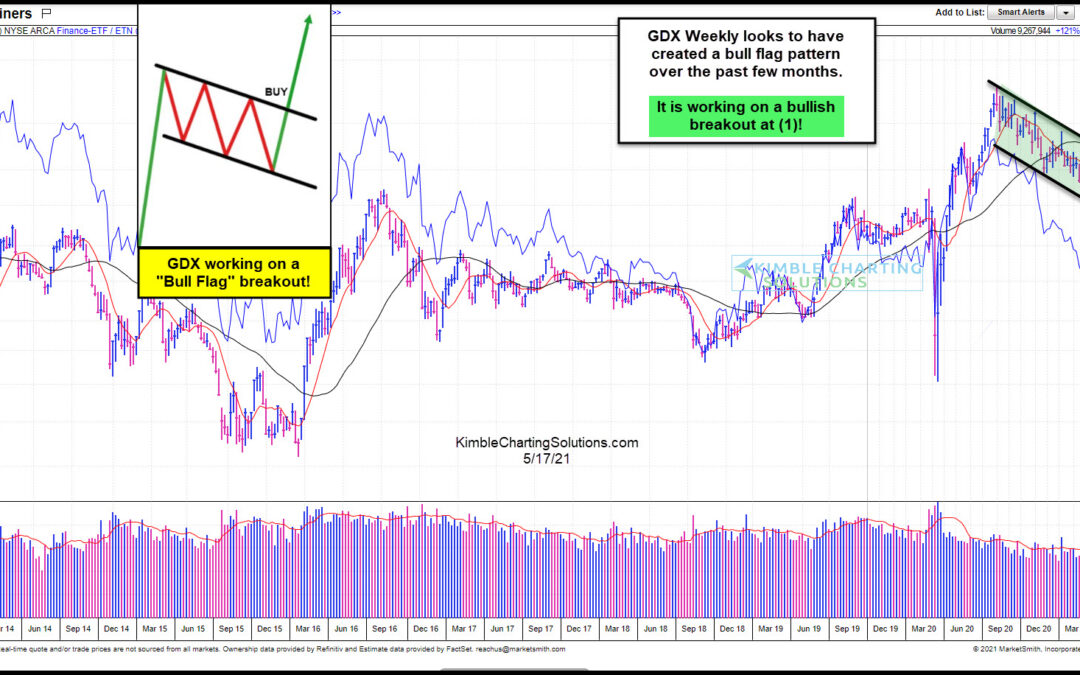

by Chris Kimble | May 18, 2021 | Kimble Charting

Gold has been working its way higher over the past 5 weeks and the gold mining stocks are reaping the benefits. Today’s chart from Marketsmith.com offers an intermediate-term look at the Gold Miners ETF (GDX) and its recent bull flag chart pattern and buy signal. As...

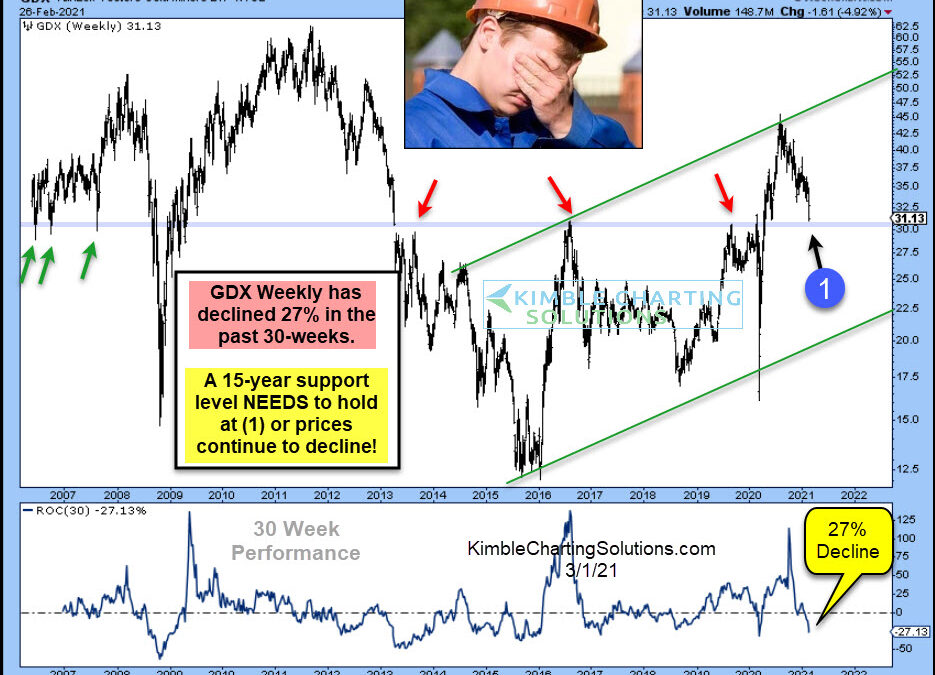

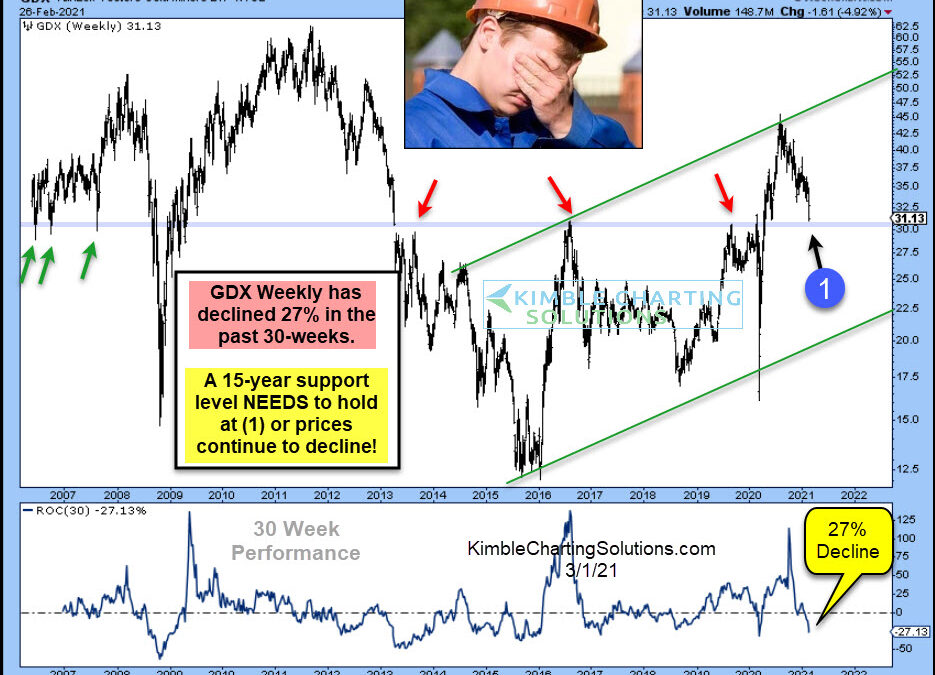

by Chris Kimble | Mar 1, 2021 | Kimble Charting

The past 8-months have been great for the broad markets, the same cannot be said for Gold Miners. Gold Miners ETF (GDX) has lost nearly a third of its value since peaking last August. This decline has taken place inside a bullish rising channel, that started at the...

by Chris Kimble | May 7, 2020 | Kimble Charting

Are Gold & Silver Miners about to send a bullish message for the first time in 10-Years? We will see soon! The Gold & Silver Miners Index (XAU) has created a series of lower highs and lower lows inside of falling channel (1) over the past decade-plus. The...

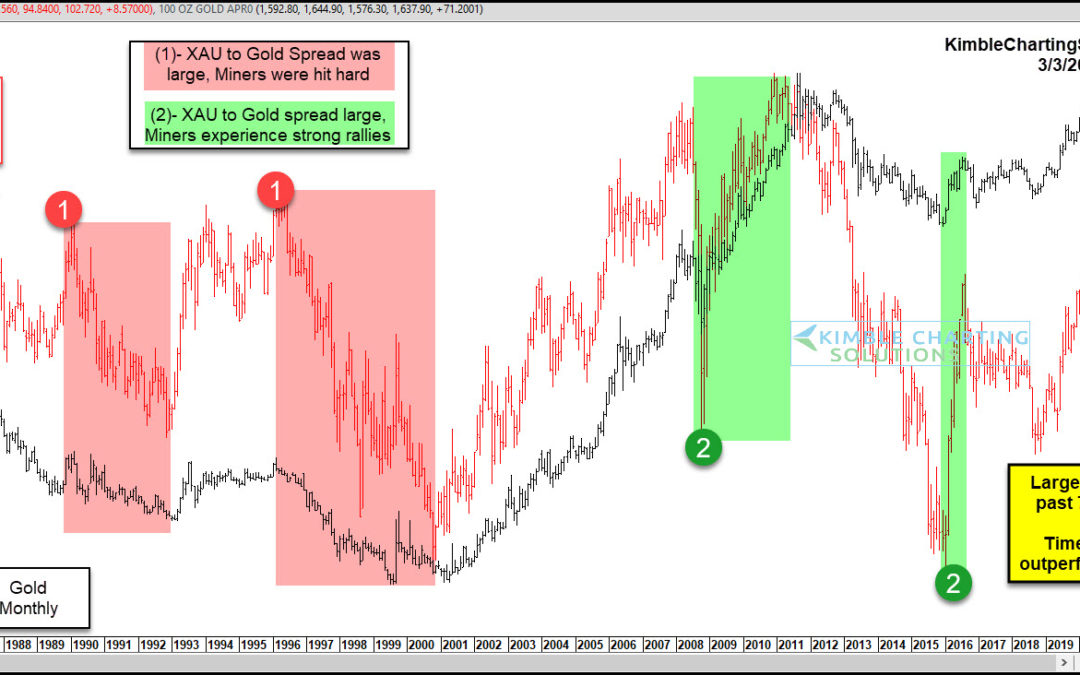

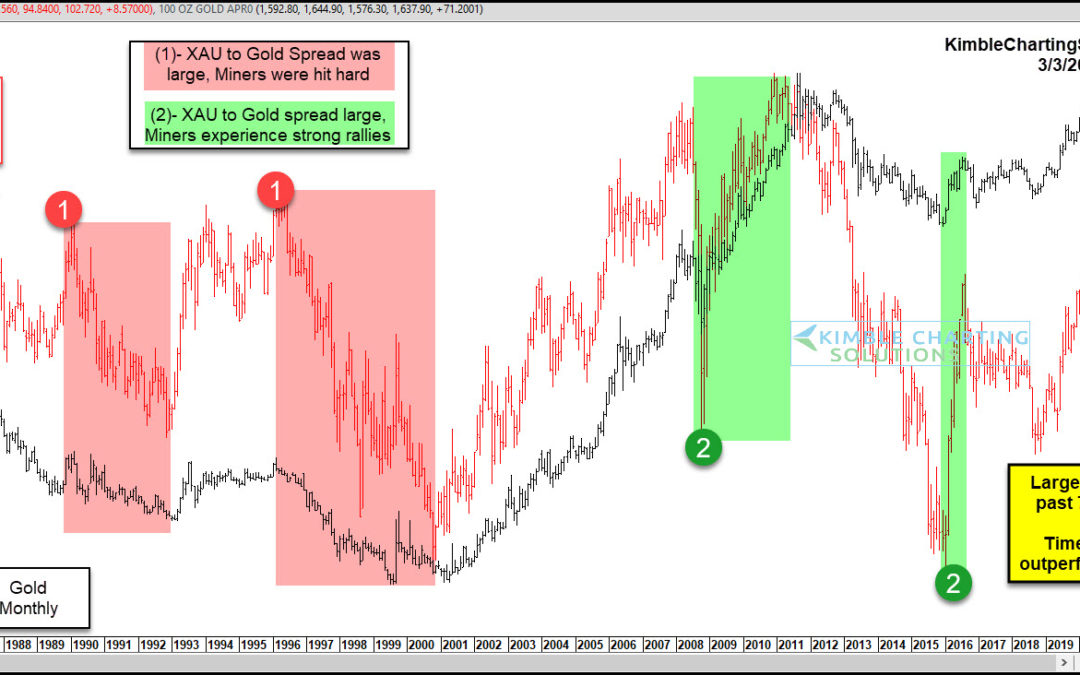

by Chris Kimble | Mar 4, 2020 | Kimble Charting

I like to look at price spreads, particularly spreads between related assets. When they become too wide, they point to a strong potential for mean reversion (and an opportunity for investors). Today, we look at the spread between the Gold/Silver Miners Index (XAU) and...

by Chris Kimble | Jan 13, 2020 | Kimble Charting

In September of 2019, Gold Miners ETF (GDX) testing long-term resistance at (1), and then it quickly declined 15%. This resistance level has been heavy for GDX has it failed to break above this level twice in 2013 and once in 2016. Each time GDX peaked in those years,...