by Chris Kimble | Aug 5, 2019 | Kimble Charting

Precious metals are beginning to catch the eye of investors around the world. In particular, Gold has been performing quite well. But, as many investors know, it takes two to tango. And silver is an important part of that tango. Perhaps more important than gold. Why?...

by Chris Kimble | Jul 18, 2019 | Kimble Charting

Silver (NYSEARCA: SLV) has been in a bit of a slumber when compared to the price action for Gold (NYSEARCA: GLD). Precious metals bulls hope that this about to change, as bullish action from Silver is necessary to confirm any bull market / move in metals. Today’s...

by Chris Kimble | Jul 15, 2019 | Kimble Charting

Silver (NYSEARCA: SLV) is an important cog in the precious metals world. Not only is it a core precious metal but it is often a leading indicator for metals bulls. Silver is a good risk-on / risk-off indicator. When it is out-performing Gold, it is risk-on. When it is...

by Chris Kimble | Jul 11, 2019 | Kimble Charting

Gold bulls spend much of early 2019 waiting for a catalyst to fuel another rally leg. They wouldn’t have to wait long… A stealth shift in talking points and monetary policy from the Federal Reserve brought a very dovish tone. And this sent interest rates lower, along...

by Chris Kimble | Jul 9, 2019 | Kimble Charting

Are Gold Miners about to “Cut Loose” to the upside? A key breakout test is in play, that will go a long way in determining this important question. This chart looks at Gold Miners ETF (GDX) on a weekly basis the past few years. GDX peaked three different...

by Chris Kimble | Jun 27, 2019 | Kimble Charting

This chart looks at the Silver/Gold ratio over the past 25-years. Historically bullish investors in Gold & Silver receive a positive message when this ratio is heading higher. When the ratio is heading lower, historically rallies in Gold often times have been...

by Chris Kimble | Jun 7, 2019 | Kimble Charting

Is the hard-hit Euro about to send a bullish message to Gold, Silver & mining stocks? Looks like it this week! Metals bulls want to see the Euro head higher to send them a bullish message. For the past 14-months, the Euro has created a series of lower highs and...

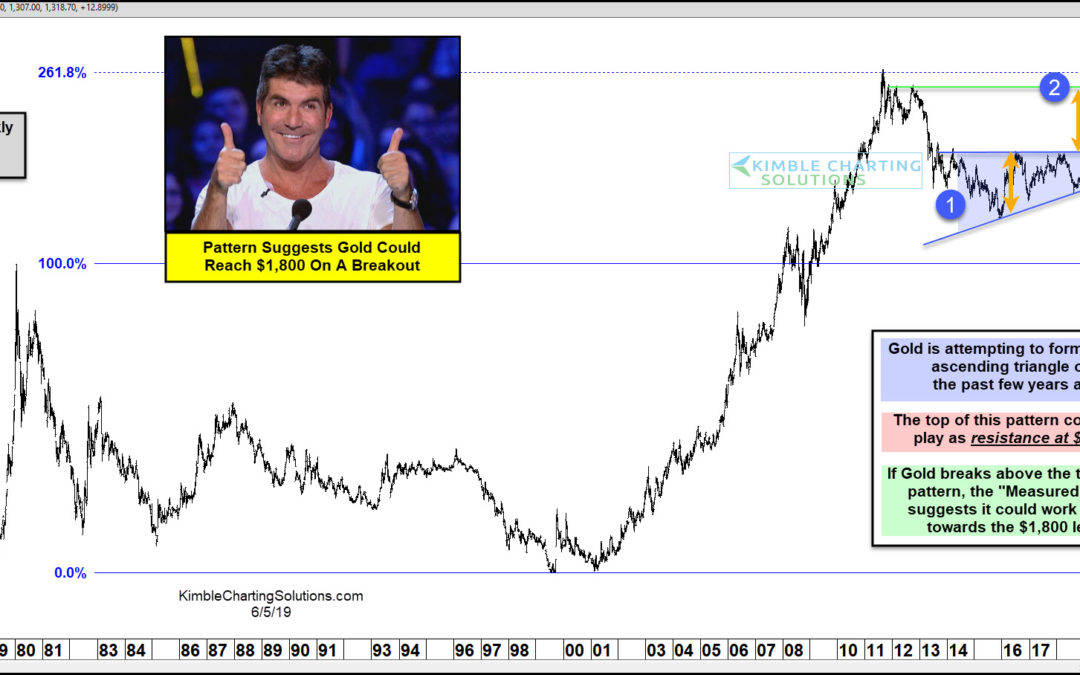

by Chris Kimble | Jun 5, 2019 | Kimble Charting

Is Gold finally about to break out from a 5-year bullish ascending triangle pattern? We will find out very soon! The price action of Gold since 2014 looks to be a series of flat tops and rising bottoms. It could be forming what is called a “Bullish Ascending...