by Chris Kimble | Apr 28, 2022 | Kimble Charting

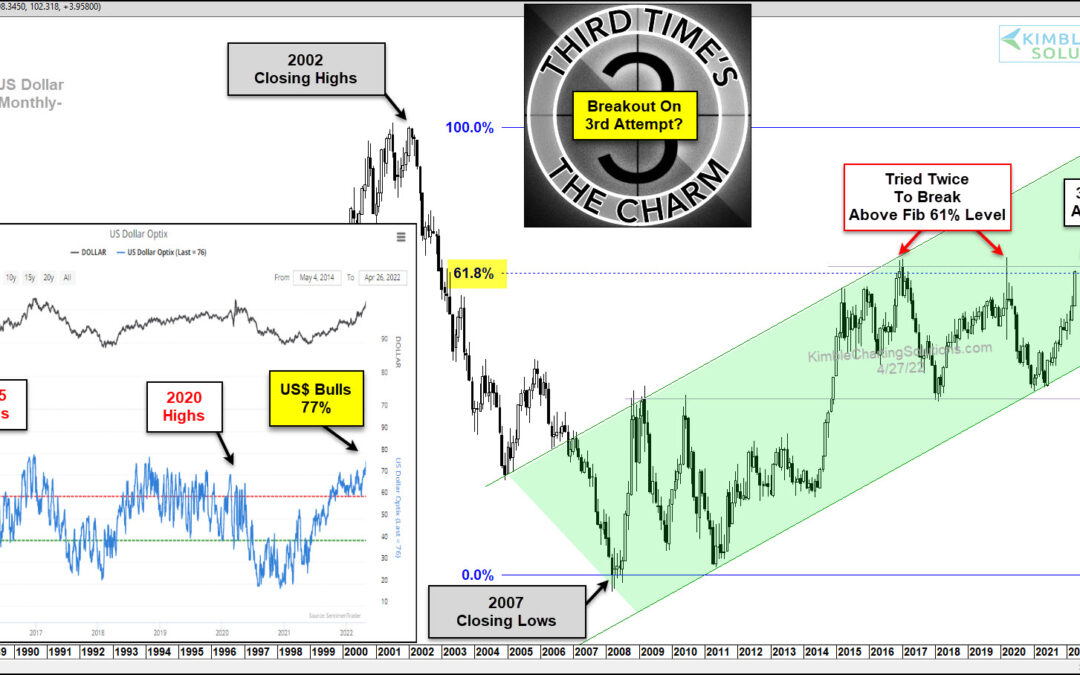

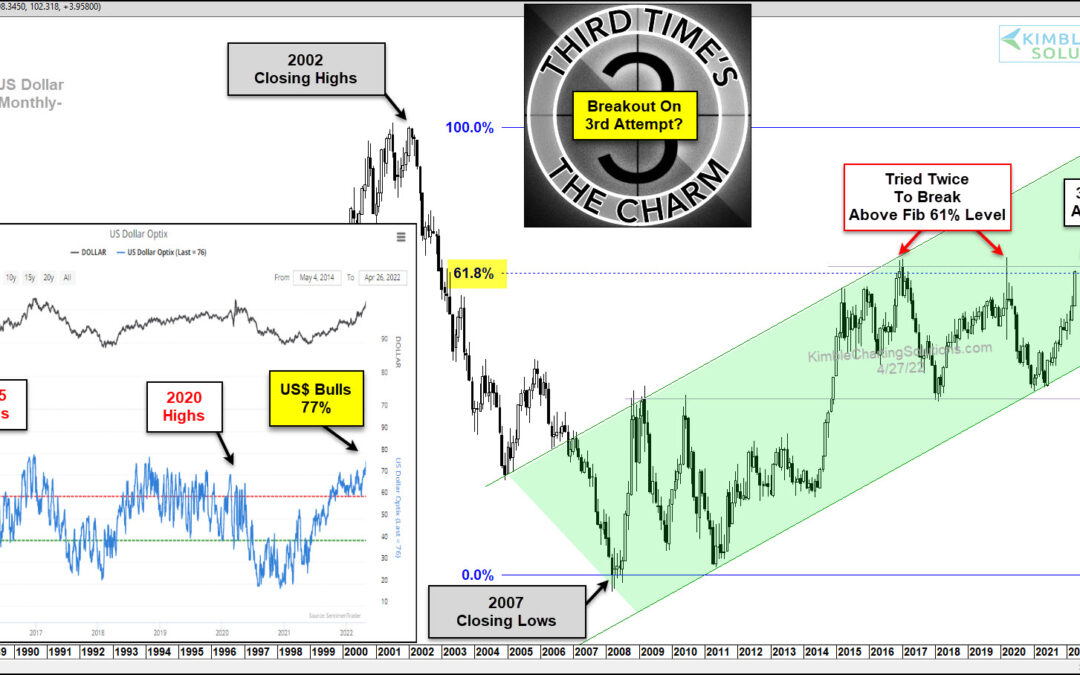

The US Dollar currency has rallied sharply over the past year. Is it time to give King Dollar his crown back? Looking at today’s long-term chart, we can see that the US Dollar has traded in a broad rising channel since the 2007 low. And the 2015 and 2020 highs formed...

by Chris Kimble | Mar 23, 2022 | Kimble Charting

Six years ago, the Economist magazine illustrated the mighty US Dollar. And that marked a peak that has since been tested but not broken out beyond. The latest rally for the US Dollar has it once again looking strong, but yet again facing important price resistance....

by Chris Kimble | Mar 7, 2022 | Kimble Charting

Over the past few decades, the U.S. Dollar has been weakening. Could this weakness be coming to an end? Today’s long-term “monthly” chart highlights an important test for the U.S. Dollar… and the global financial complex! Here you can see King Dollar has been in a...

by Chris Kimble | Feb 16, 2022 | Kimble Charting

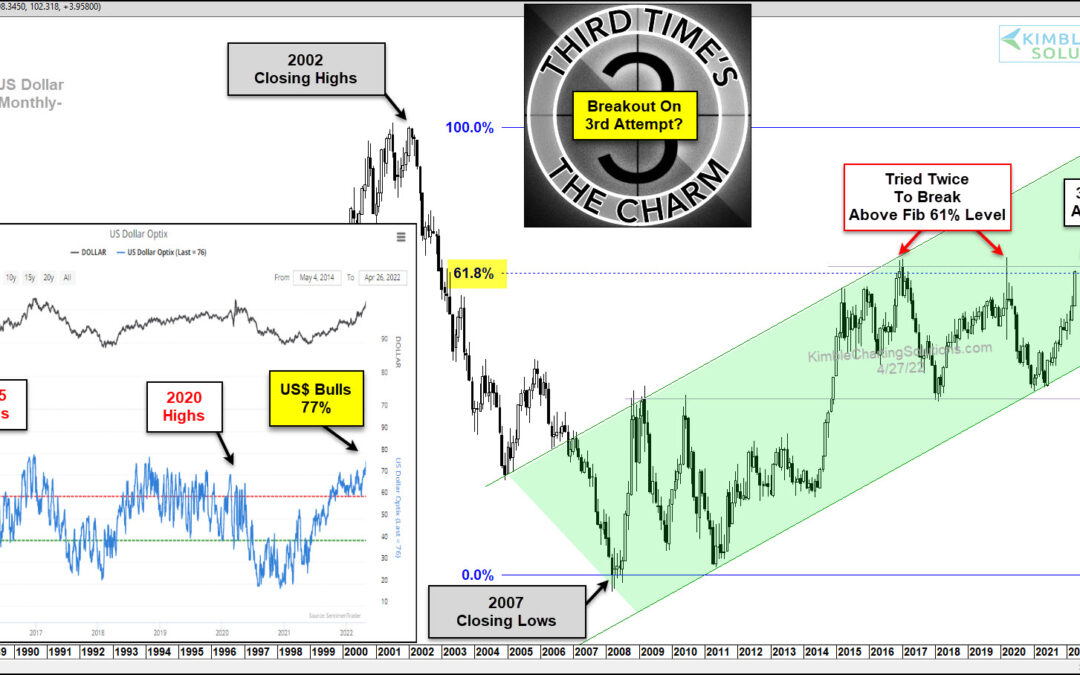

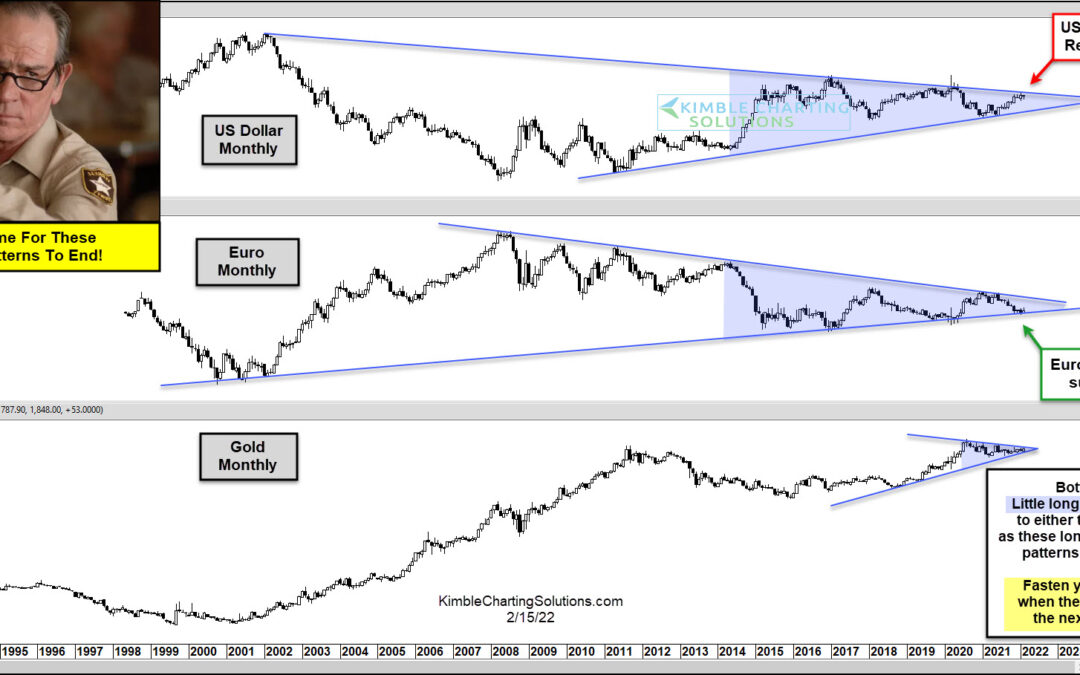

The price of Gold has been consolidating for several months. And just when you think it’s going to breakout, sellers show up. But Gold hasn’t seen enough selling to really move price substantially lower. This has lead to a narrowing pattern that should resolve soon....

by Chris Kimble | Jan 27, 2022 | Kimble Charting

Commodities were already in a slump when coronavirus hit in 2020. That crash sent commodities to the lowest levels in decades. A quick economic rebound led to a return of demand which in turn led to shortages in 2021 and into 2022. So now what? Well, if you look at...

by Chris Kimble | Jan 13, 2022 | Kimble Charting

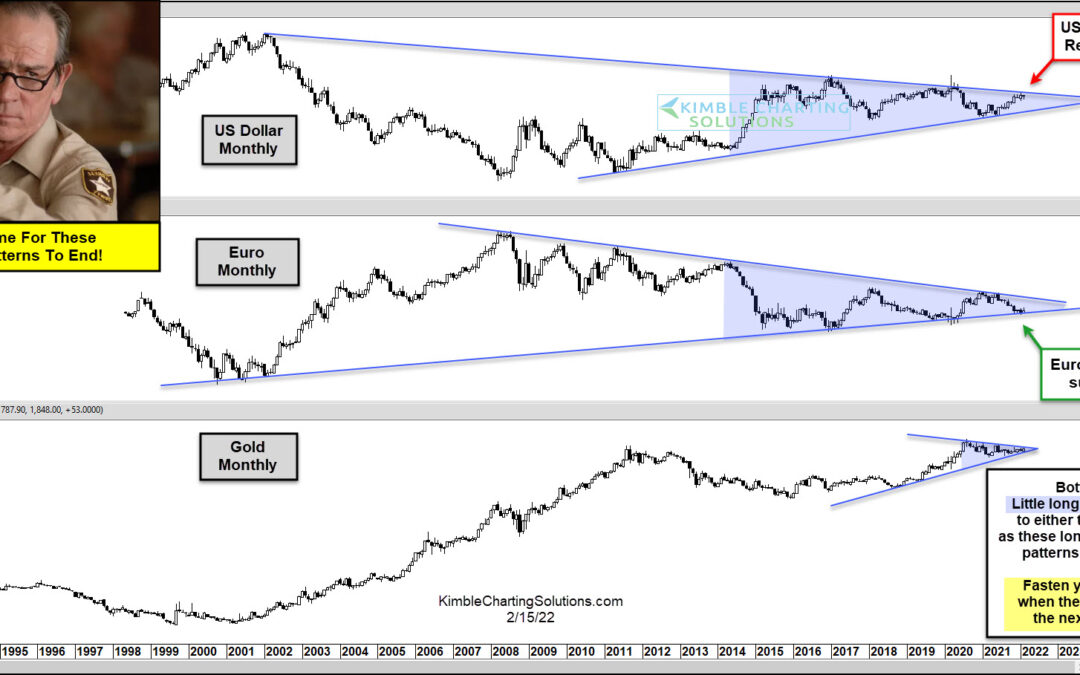

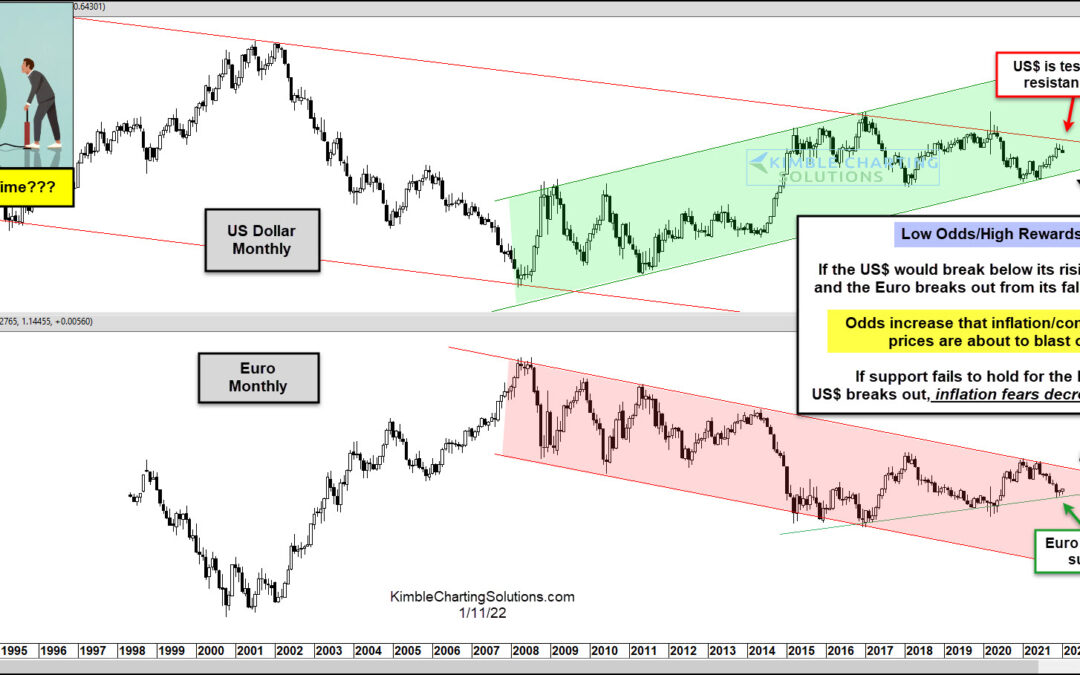

Current data suggests that inflation has been in our everyday lives for several months. And today’s Producer Price Index data was pretty ugly. BUT… could inflation be peaking? Today’s chart 2-pack offers a glimpse of why inflation could subside over the near-term....

by Chris Kimble | Jan 4, 2022 | Kimble Charting

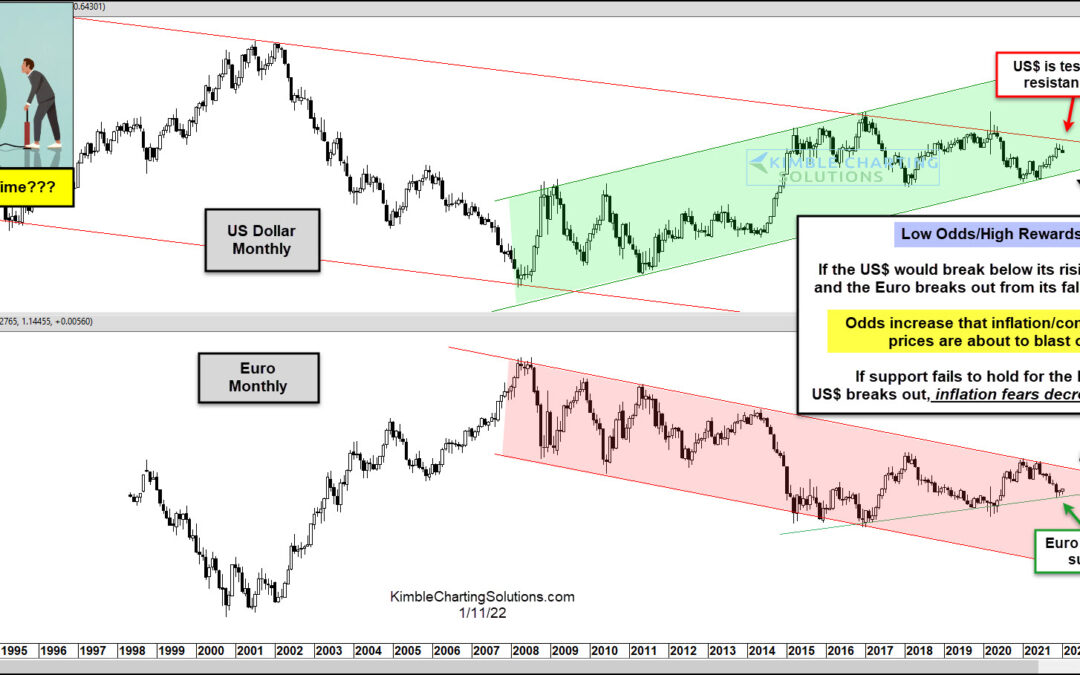

The recent strengthening in the US Dollar is catching the eyes of traders and investors alike. King Dollar affects so many asset classes, including its own. A stronger US Dollar means a weaker Euro. Today, we look at the recent trading decline of the Euro on a...

by Chris Kimble | Nov 24, 2021 | Kimble Charting

The recent US Dollar Index rally is providing a headwind for commodities, while pushing other currencies down. Should the rally extend further, it may create a bigger disturbance in the financial markets… perhaps even extending to equities. Today’s chart of the US...