My name is Chris Kimble, founder of Kimble Charting Solutions.

I am truly honored by your interest in learning how my research can help you.

I have a simple goal for my investment research - help people to enlarge portfolios regardless of market direction.

Having been in financial services for over 30 years, I've spoken with many individuals and financial professionals. The common desire that we all have, including me, is to enlarge our portfolios with the least amount of risk!

If you were caught by surprise in 2008 and suffered because losses went well beyond tolerable, you are not alone. Many still continue to find it difficult to make confident investment decisions. Why? I believe the noise from media sources, and in our own heads, plays a significant factor in making good investment decisions.

My research is intended to simplify investment decisions and increase confidence with charts that are clear as to the pattern at hand and action to take.

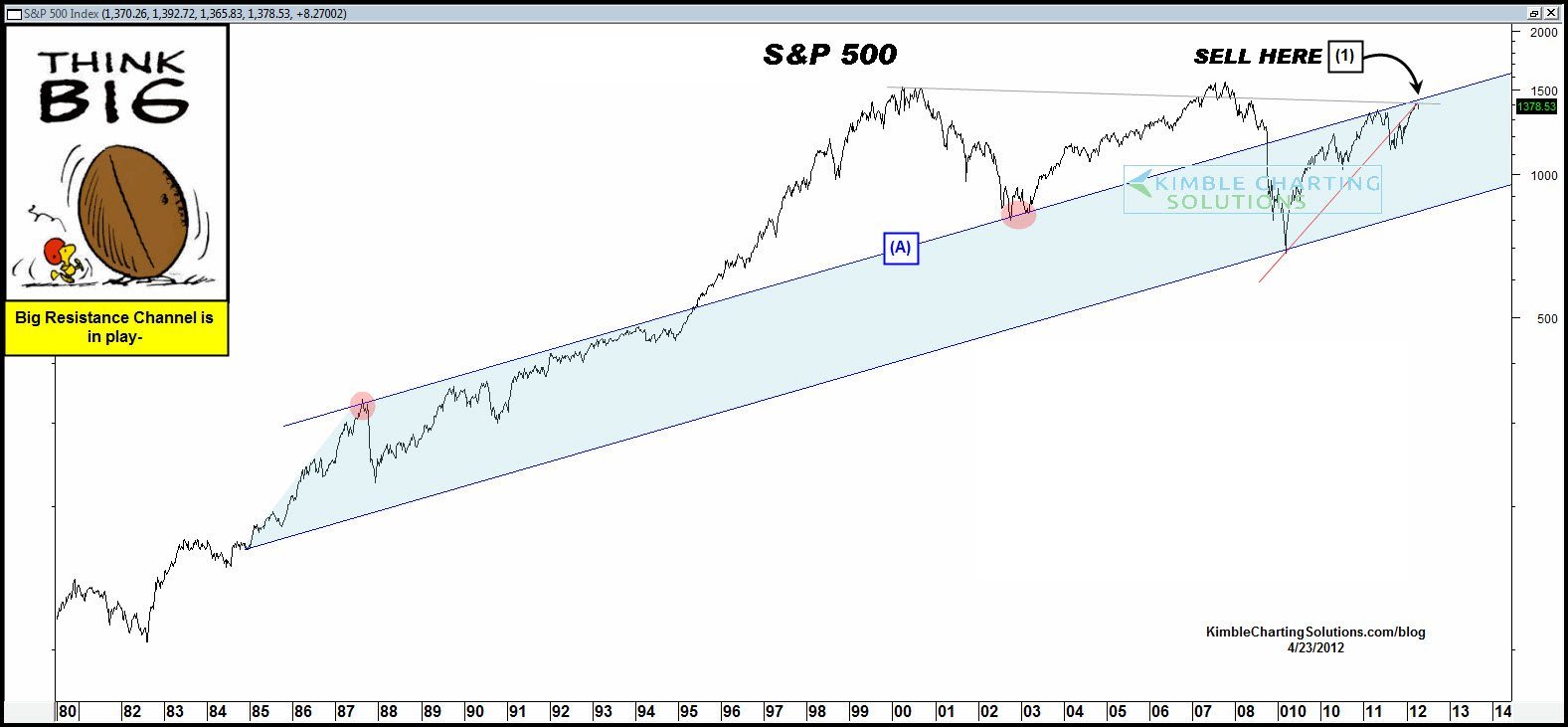

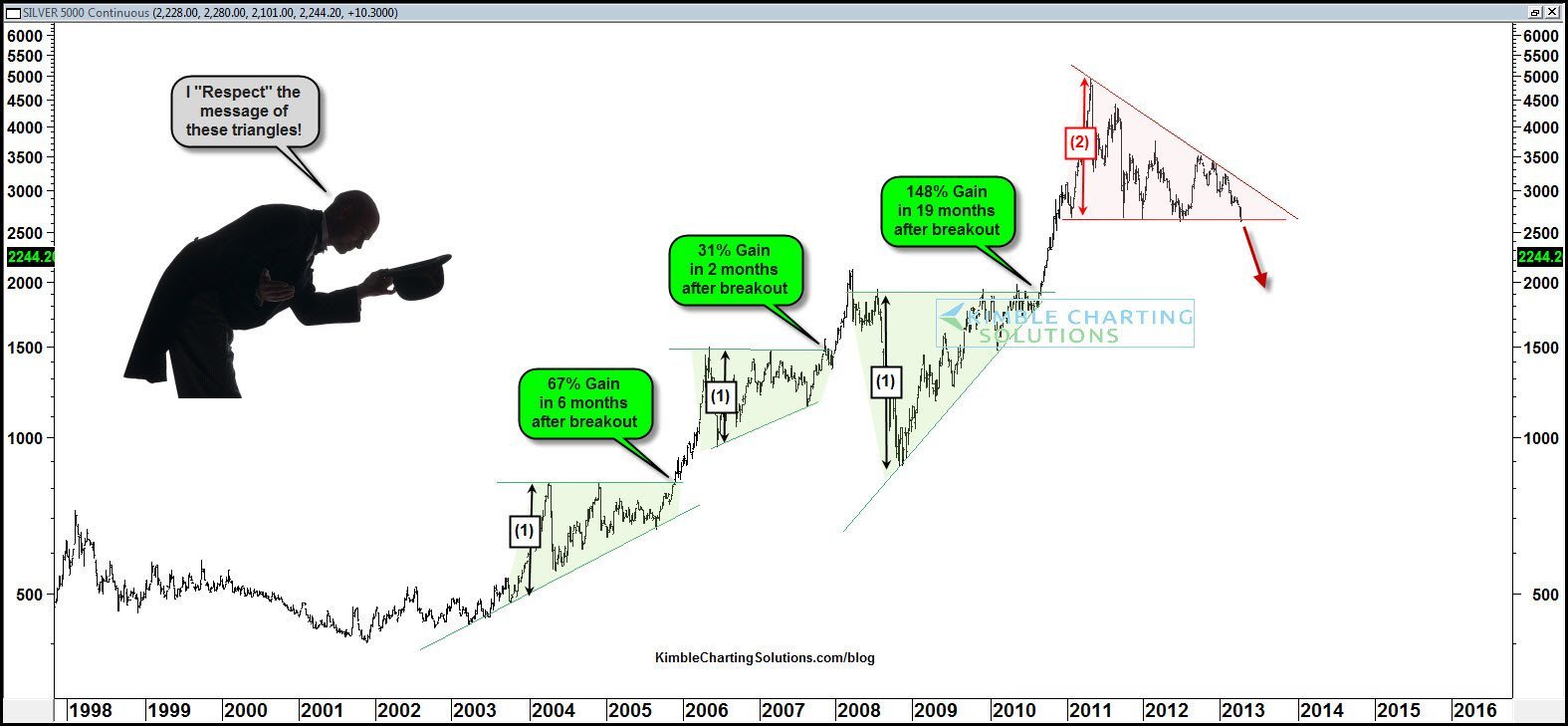

If you are new to Kimble Charting Solutions, you will often see the term "Power of the Pattern". This describes the type of research I do on a daily basis. I don't attempt to predict what will happen or respond to news or opinions of the world. Rather, I look for chart patterns at extreme exhaustion points that have a high probability of reversing. These extremes reflect excess fear and greed of global investors and what I seek to help people capitalize upon.

By providing research showing markets at extremes of long term resistance or support, and including bullish / bearish sentiment readings when available, I attempt to help people simplify their decision-making, reduce risk, increase confidence and improve results.

Last, I don't tell people what to do but rather empower them with information to help improve confidence and conviction in their decision-making.

I invite you to watch my video below to learn more about Kimble Charting Solutions:

MORE CURRENT VIDEO EXAMPLES OF SUBSCRIBER CONTENT CLICK HERE

Easy To Follow Research

Simple Isn't Simplistic

Tops, Bottoms, No Middles

Identifying Extremes to Spot Reversal & Breakout Opportunities

Buy on Support

Sell At Resistance

Short On Breakdowns

MORE DETAILS ON WHAT WE DO CLICK HERE

Who We Help

My research is suitable for people managing their own individual portfolio or professionals responsible for managing client or institutional assets.

This is not an investment advisory or trading service. I’m looking for people who draw their own conclusions and make their own investment decisions. That said, I do share positions I am personally taking given the pattern and opportunity at hand.

Members will best capitalize on my research by combining it with the trading tools / methods they currently employ toward making even better decisions.

Finally, patience is key to allow opportunities to materialize. Those that are will benefit most from my research.

Thank you!

1) A simple easy to understand approach

2) Clear information about each product and the opportunity to receive free updates to get a feel for what is offered and how it can be used

3) Results, I made profitable trades

Thanks and I look forward to learning with you

Gratefully,