What You Receive After Subscribing

First Things First

The #1 Purpose of the Research – empower individuals and financial professionals to improve decision-making and results.

Leave nothing to chance: you are paying for this research, so review everything you receive and take the time to contact us by email, phone or skype to address your questions – any question

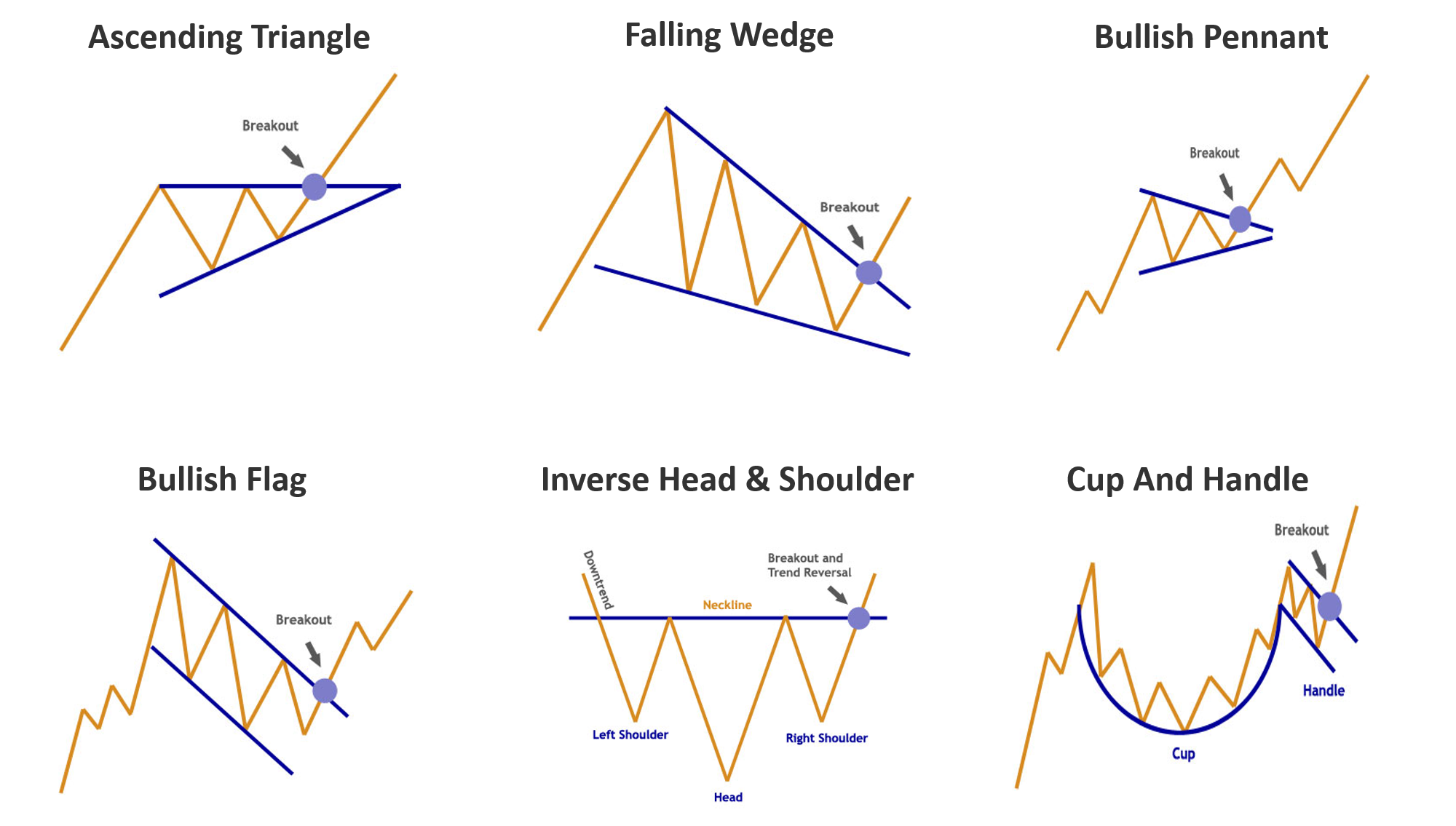

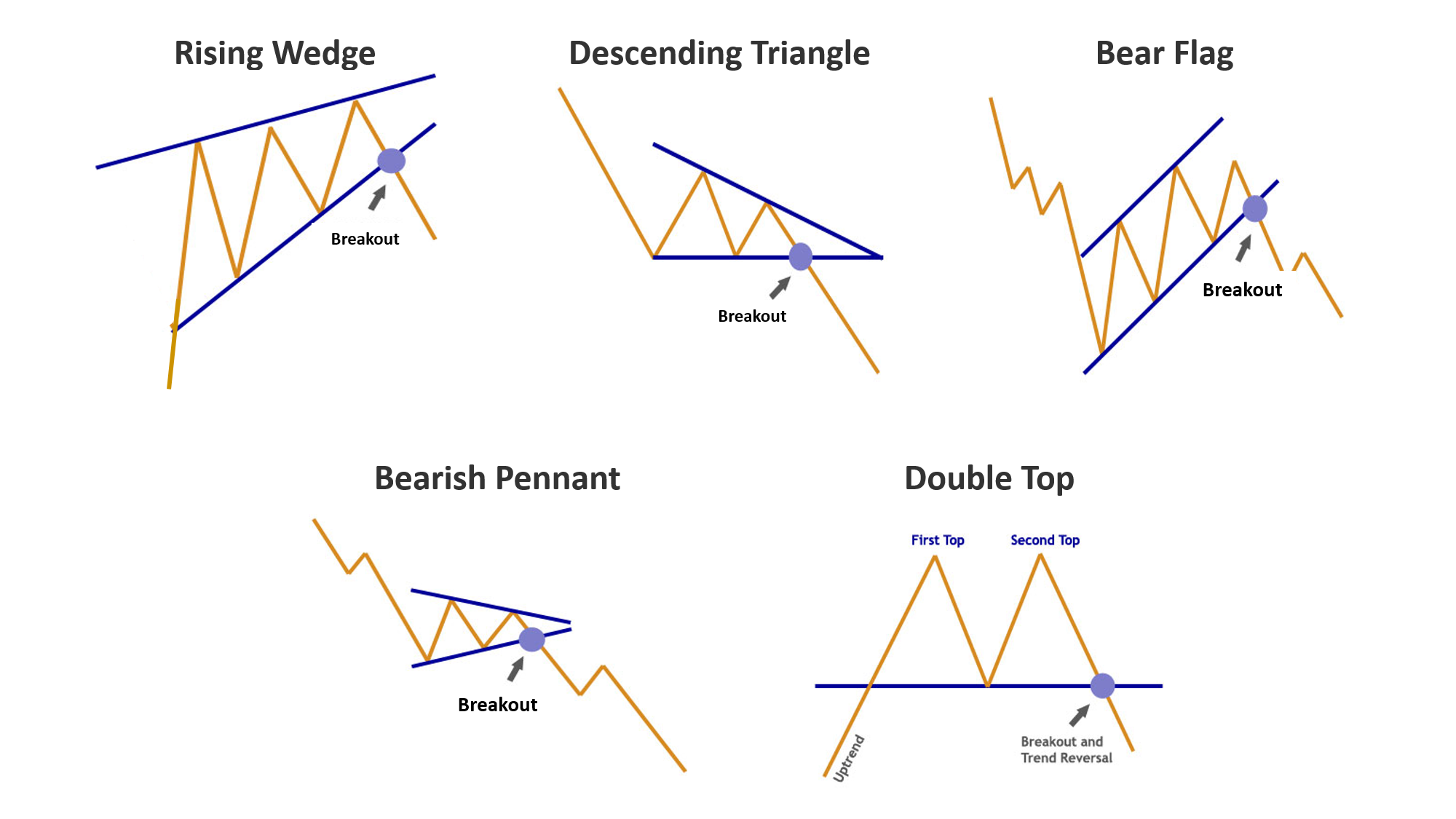

What we don’t do: we don’t predict/forecast markets. We provide pattern analysis because we believe price and pattern tell you everything you need to time when to buy, sell or short

Favorite Patterns I Look to Identify for You

POSITION/TRADE ALERT EXAMPLE

(Premium, Sector/Commodity and Metals Subscribers)

Action to be taken is s emailed to your inbox real time following an internal alert triggered & Chris prepares the following:

- Email Subject: “Taking Action” including long, sell or short and the name of the asset

Email Body includes

- chart showing pattern, breakout & action I’m taking

- Vehicle type (99% of the time it will be an ETF or individual stock)

- Initial stop

- Initial resistance (when identifiable)

- Comments on the reason for the action. They will be brief – very brief. I let the pattern do most of the talking

- Updates when I take action to sell some or all of the position and/or move stops up

(I expect members to take, or not take, action, choose the investment vehicle and stop method on assets that best meet their portfolio objectives, risk and “trading” style)

Subject: Taking Action: Buying Apple (AAPL)

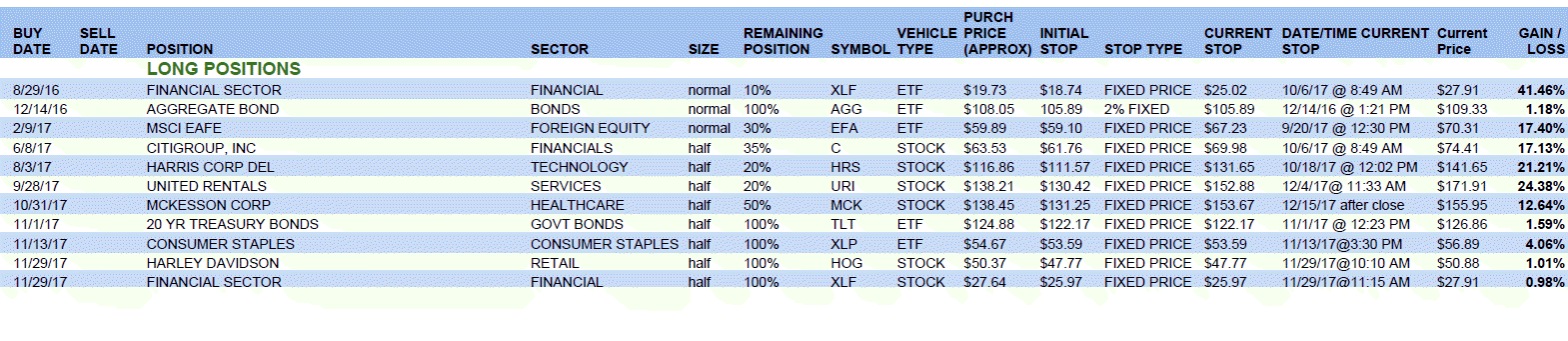

SAMPLE POSITION SUMMARY

We send a position summary twice weekly for Premium. Weekly-Combo and Sector/Commodity Members

The summary includes open positions with several pieces of information based on how I am managing the position/trade

The summary also includes closed positions for the past 30 days. (see example here)

WHAT YOU RECEIVE WITH WEEKLY REPORTS

(Premium, Weekly Combo, Global Trends, Sector/Commodity and Metals Subscribers)

Metals and Sector/Commodity Reports: Cover assets showing extremes for potential breakout or reversals in the 9 S&P sectors, occasional coverage of a few individual stocks with seasonally strong performance.

Global Trends Report does not provide position/trade alerts but rather a big picture / 30,000 foot long-term trend and pattern analysis on several major global indices, influential indicators such as high yields, and a proprietary indicator that has been quite helpful at giving “advance warning” of major market turning points.

Choose the Research that Meets Your Needs

Have Questions?

Connect with people who have 25+ years of investment knowledge & experience helping individuals and financial professionals.