Additional Premium Member Details

I am very honored by your interest in becoming a Premium Member. If you want everything I produce on a daily basis and have access to my best pattern observations and the most trade alerts, take advantage of Premium.

I am very honored by your interest in becoming a Premium Member. If you want everything I produce on a daily basis and have access to my best pattern observations and the most trade alerts, take advantage of Premium.

Goal: provide research to help investors enlarge their portfolios regardless of market direction by looking for charts patterns at extreme points of “exhaustion” that have a high probability of reversing.

Free research that doesn’t provide value is expensive, while quality research can pay for itself many times over

Chris Kimble (Founder & CEO)

SUMMARY OF WHAT YOU RECEIVE AS A PREMIUM MEMBER

- Daily chart research and commentary

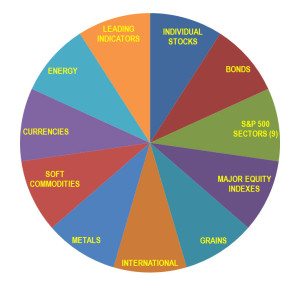

- Over 50 markets/sectors covered

- 100dreds of patterns monitored daily to alert you on breakout and reversals

- Pattern opportunities in broad markets, sectors, commodities, metals & select individual stocks

- Trade Alerts sent immediately via email

- Initial stop, adjustments & ongoing position updates

- Positions summary sent twice weekly

- Special reports

- Monthly “Connect Series” webinars

- All weekly research reports are included!

- Proprietary leading indicator, advance decline & sentiment analysis

- Live member webinars

- Occasional custom pattern analysis on a specific asset of interest to you

- A “Fact Sheet” is provided for your completion to help us know you better and make the most of the research

“Hey Chris Thanks again for all your hard work. I would love to come out and meet you or would love to attend a currently scheduled meeting. Please let me know how your schedule looks in the coming days and weeks. I have been a premium member for almost a year. I have recouped my investment a 100-fold. So thank you so much for helping me, my family and my clients. I want to make sure you are happy and see if I can do anything for you. I would like to gain greater access to you and I am interested in being a founding member of a new “premium premium” membership. Please let me know your thoughts. Thank you again and I look forward to speaking to you.” Jim W. from Florida

We look for extreme patterns that may provide opportunities to take positions by reviewing hundreds of assets

in the major market indices, sectors, commodities and the metals markets.

HOW WE HELP MEMBERS CAPITALIZE ON THE POWER OF THE PATTERN

I produce research for premium members daily, sometimes more than once a day.

High probability opportunities are found at long term multi-year weekly support or resistance. For example, I look to identify breakouts out of falling resistance or wedge patterns or bullish ascending patterns and alert members as soon as my alerts are triggered.

Alerts consist of sending an email with “Taking Acton” in the subject line, the asset, action to be taken and the date. In the body of the email I include the asset name, symbol, chart with pattern analysis showing where and why I’m taking action, and the initial stop price. And I alert members when I take profits and update stops along the way.

To keep you on track with positions, we email a positions summary twice weekly. (we also plan to introduce a members-only live 24/7 positions report in the future)

Minimizing loss and reducing risk is a big priority. If price turn against us quickly, I may not wait for stops to trigger. If you are comfortable with holding on longer, by all means, adjust stops and make decisions based on your analysis and risk profile

We provide a fact sheet we ask you to complete to help us get to know you, your management / trading style, other tools you use, books and mentors you may have learned from etc. The more we know, the better we can help you!

Members should consider position size and stops based on their risk tolerance, experience and objectives.

We truly want to hear from you along the way so we can help you make the most of the research.

EXAMPLES OF HIGH PROBABILITY PATTERNS IDENTIFIED FOR PREMIUM MEMBERS

PATTERN: WEEKLY PENNANT PATTERN – FINANCIAL SECTOR

Below is an example of a multi-year pennant pattern that had been forming in the financial sector (XLF). This type of pattern, including the multi-year time frame, was set up for a huge move. We waited patiently and alerted members on a breakout to the upside back in late August 2016 to buy XLF or any bank or financial stock they had been following.

While I alert members when I take profits, know that my primary expertise is pattern analysis. I expect each member to adjust stops, take profits and manage positions based on your risk parameters and objective (or your clients’ objectives if a financial professional)

Below is a snapshot of relative XLF almost two years following the breakout of it’s pennant pattern

PATTERN: WEEKLY MULTI-YEAR CHANNEL AND DUAL SUPPORT – APPLE

Below is an example of a weekly pattern & opportunity in Apple (AAPL) that I alerted members to buy in Feb 2018. Apple suffered a precipitous decline and was on two support lines going back approx 2 years.

Below is an update showing the relative strength of Apple vs S&P 500 from the time we purchased. This is another aspect of my research, to look for relative strength opportunities in stocks over buying the broad indexes![]()

![]()

If I have to sum it up, this is such powerful information you’re providing me with, it simply cannot fail to produce tangible results. 1.3 times the cost of the annual subscription paid in exactly 21 hours is no joke, and we did it without crazily risky leveraged derivatives: just a great technical setup, a good ETF, eyes on the stops, and cashed out as soon as the gains proved us right; no more no less. No need to stretch the rubber band, the next chart will bring more profits, in the meanwhile, there’s nothing as good as more cash!!! Thank you Chris, Premium Memberships beats everything out there. Luca from Italy

Tool To Help You Remain Objective

To avoid potential bias toward assets I may be tempted to favor at times, I will often quiz myself by hiding the asset name. I share these with you at times to test yourself.

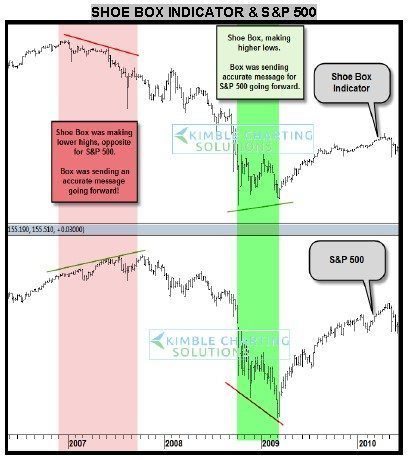

My “Shoe Box” Advance Warning Indicator

This proprietary indicator is a critical tool used to provide advance warning of major turning points in the broad markets. The Shoe Box tends to turn down before major highs and up before major rallies. The underlying components are proprietary but involve pricing swings in the credit markets, over weighted towards corporate credit conditions.

HOW CAN THIS TOOL HELP YOU?

We use this tool as a gauge to suggest when to overweight allocation to equities on a breakout of the shoe box and underweight equities on a break of support. A break of BOTH the Shoe Box indicator and broad US equities signals an opportunity to take or add to short positions for those looking to capitalize on the downside.

CLICK HERE TO VIEW MORE PATTERNS IDENTIFIED FOR MEMBERS

Chris: just wanted to pass along some feedback to you on your blog and premium subscription posts. I paper traded your recommendations for six (wasted) months before going “live” on 1 Jan this year. Since then, my trading account is up 70.1% as of today’s close – which is to say that, thanks to you, sir, I’ve had a terrific DECADE these last 100 days or so, and the premium service has paid for itself in spades. As an aggressive investor, I use your posts to place swing trades using various option strategies and a strict selling discipline which, regrettably, I learned the hard (pronounced: “EXPENSIVE”) way… in all candor, Chris, yours is far and away the best subscription I’ve ever had in twenty-some years of active trading. The power of the pattern rocks! Thank you again for all that you do! Scott A. from California

I look forward to helping you capitalize on the Power of the Pattern!

Best Regards,

Chris Kimble

Founder Kimble Charting Solutions