CLICK ON CHART TO ENLARGE

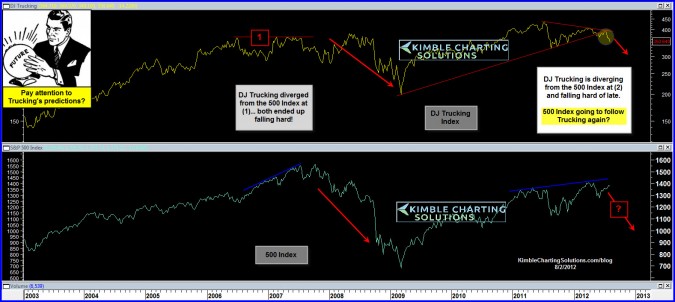

The DJ Trucking Index reflected weakness back in 2007, diverging from the S&P 500 and in time both fell in price.

Since early last year, the Trucking index is creating a series of lower highs, diverging from the pattern of the S&P 500 index. Not only is a divergence taking place, the Trucking index is picking up downside momentum

Check out the chart below, related to consumption… that is sending a caution signal as well!

CLICK ON CHART TO ENLARGE

Coach’s breakdown took place in 2007, long before the S&P 500 was heading south.

Coach’s breakdown sending a message about the future of the broad market, again? Stay tuned!

Andrew…

Should have looked like this one! Thanks for the understanding.

http://advisorperspectives.com/dshort/guest/Chris-Kimble-120802-Transports-and-Purses.php

Chris

No worries. I always appreciate the commentary and charts you put up….keep up the good work.

Transportation, Russell2000, divergences last weeks. Thanks for your observations.

From St. Sebastian, north Spain.

Andrew…I’m on vacation in mountains of Colorado. This thin air had me confusing purses with RV’s.

Sorry about the goof…man you should see the size of that trout I caught! 😉

Appreciate your heads up and viewership,

Chris

great observation Chris. Transports have been showing this weekness for a while as the transportation index has made lower highs from 2011-12 while the dow industrials has made higher highs. This divergence is throwing up a red flag for dow theory, violating the rule that Stock market averages must confirm each other .

Coach (COH) is not an RV company, it’s a luxury consumer goods company. Just FYI. Besides that, nice analysis.