by Chris Kimble | May 21, 2024 | Kimble Charting

When we discuss bull markets and areas of leadership, we usually point to out-performance. We’ve been writing a lot about precious metals lately, and today we look at Silver. Two things we love to see: Silver out-performing Gold (sign of risk-on), and precious metals...

by Chris Kimble | May 17, 2024 | Kimble Charting

Precious metals have been very strong over the past two years, with Gold breaking out of a historic bullish pattern. Is it time for Silver to do the same? Silver has rallied sharply but is facing heavy resistance. Let’s look at the chart! “The facts, Ma’am. Just the...

by Chris Kimble | May 8, 2024 | Kimble Charting

Precious metals have enjoyed a huge rally that has seen gold reach new all-time highs and silver reach new multi-year highs. There are a lot of tailwinds working for gold and silver today… global warfare, geopolitical instability, and inflation. Today we look at a...

by Chris Kimble | Apr 19, 2024 | Kimble Charting

The precious metals space continues to show impressive strength in 2024. Gold is at new all time highs and Silver has picked up the pace lately as well, testing its 5 year highs. Over the past few months, we have highlighted several trading setups in Gold and Silver....

by Chris Kimble | Apr 4, 2024 | Kimble Charting

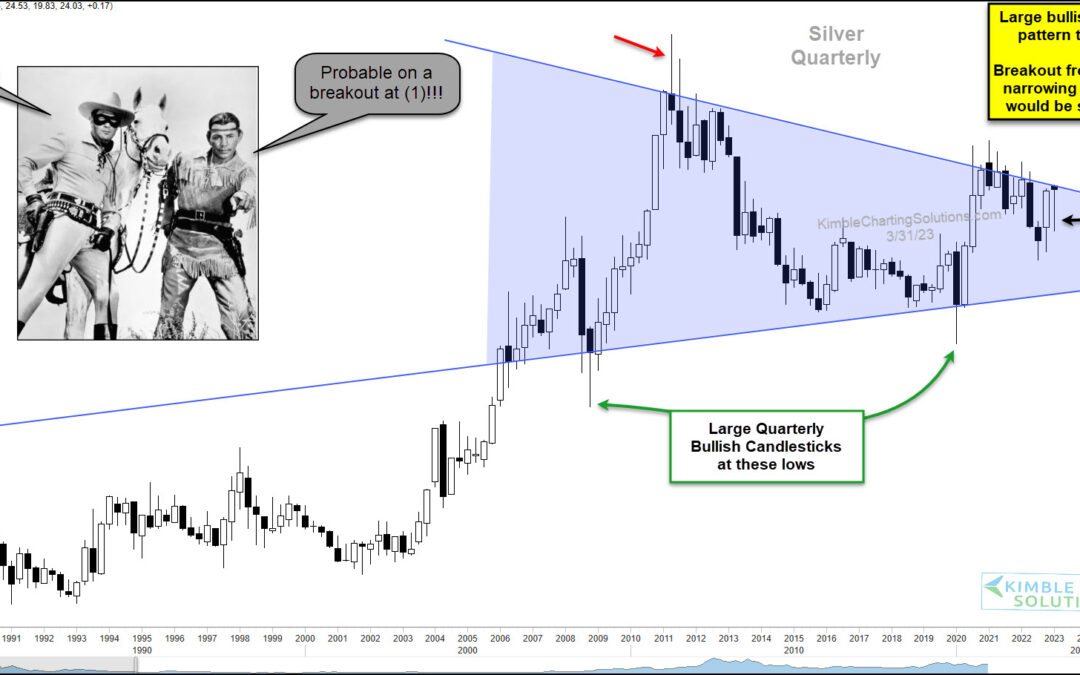

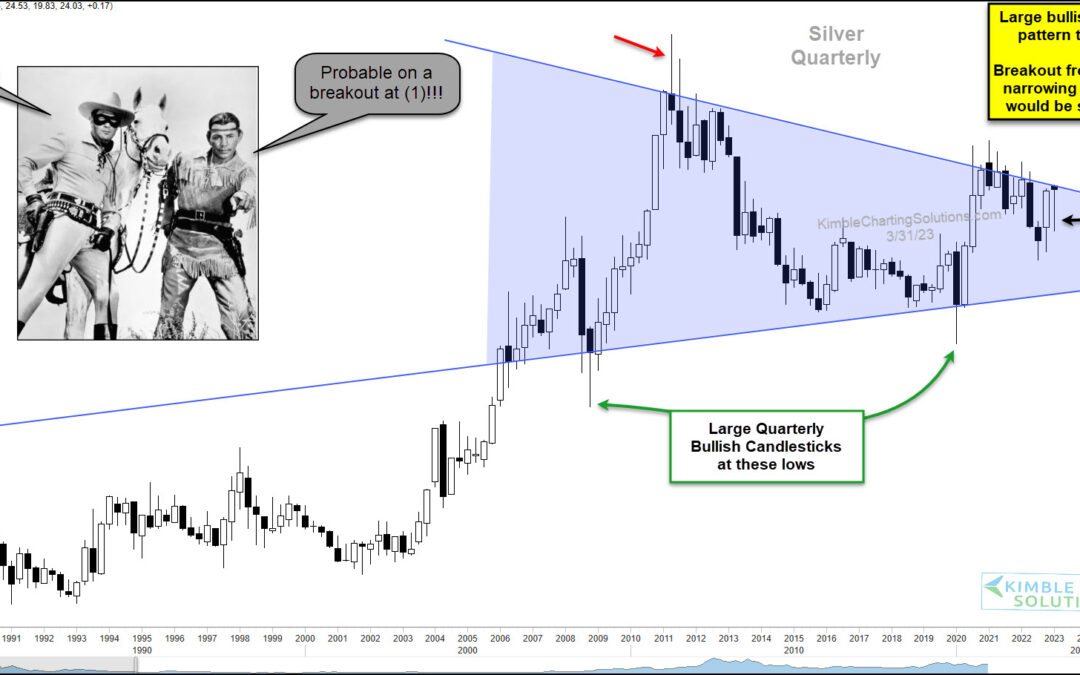

I like what I am seeing of late in the precious metals space. Gold has broken out to new highs… and now silver is beginning to show strength. Today we take a look at a long-term “quarterly” chart of Silver, as it seems that something BIG might be brewing. As you can...

by Chris Kimble | Nov 29, 2023 | Kimble Charting

Precious metals prices have quietly crept higher in recent weeks. And if the rally keeps going, Silver could trigger a very bullish buy signal. Today, we look at a long-term “monthly” chart of Silver. And, as you can see, Silver has formed a gigantic pennant pattern...

by Chris Kimble | Aug 24, 2023 | Kimble Charting

Precious metals have been a bit boring of late due to some sideways trading. BUT that boredom may come to an abrupt end shortly! Today’s chart takes a long-term view of Silver, highlighting a huge price pattern along with potential upside targets (if triggered). As...

by Chris Kimble | Apr 3, 2023 | Kimble Charting

Precious metals bulls rose sharply last summer into the heart of inflation headlines and Ukraine war news. Since that time, both gold and silver have moderated but remained elevated in a consolidation pattern. But recent price action in Silver could be a bullish...