by Chris Kimble | May 23, 2022 | Kimble Charting

The past several months has seen the US Dollar Index rally once more, pushing King Dollar up to a retest of multi-year highs. At the same time, the Euro has been sputtering and is nearing multi-year lows. In today’s long-term “monthly” chart 2-pack, we look at both...

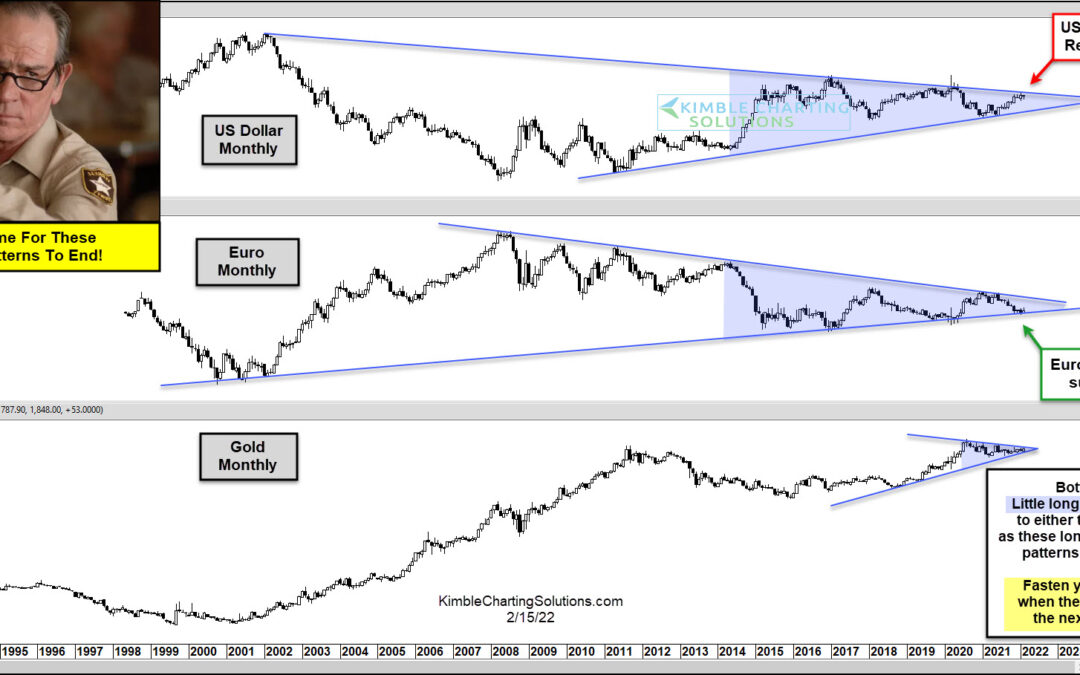

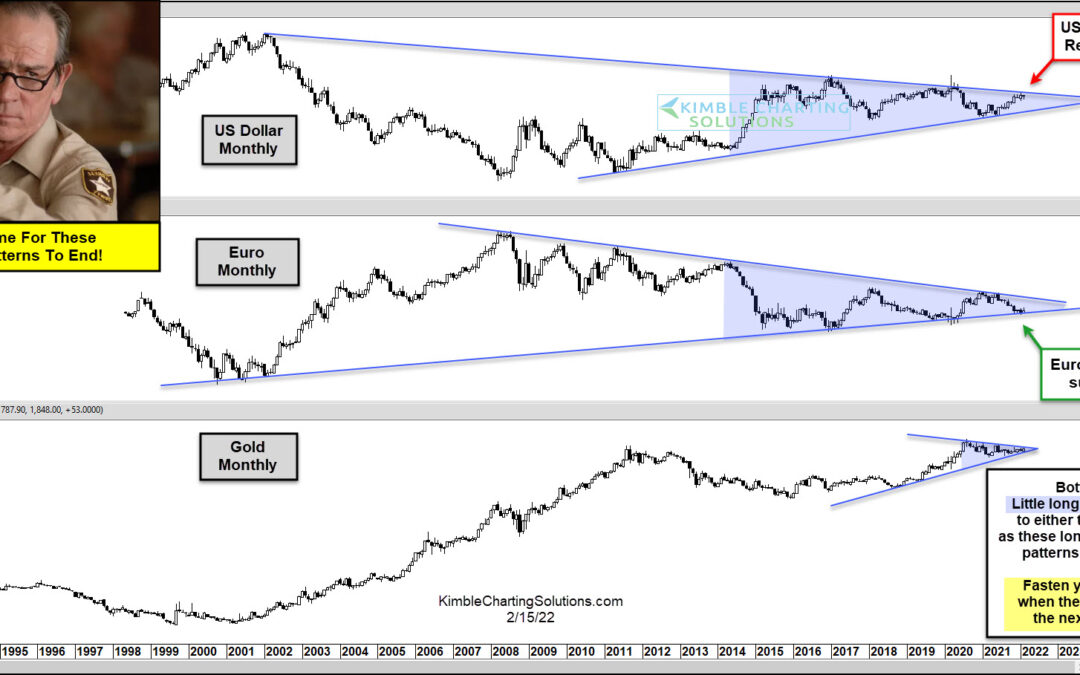

by Chris Kimble | Feb 16, 2022 | Kimble Charting

The price of Gold has been consolidating for several months. And just when you think it’s going to breakout, sellers show up. But Gold hasn’t seen enough selling to really move price substantially lower. This has lead to a narrowing pattern that should resolve soon....

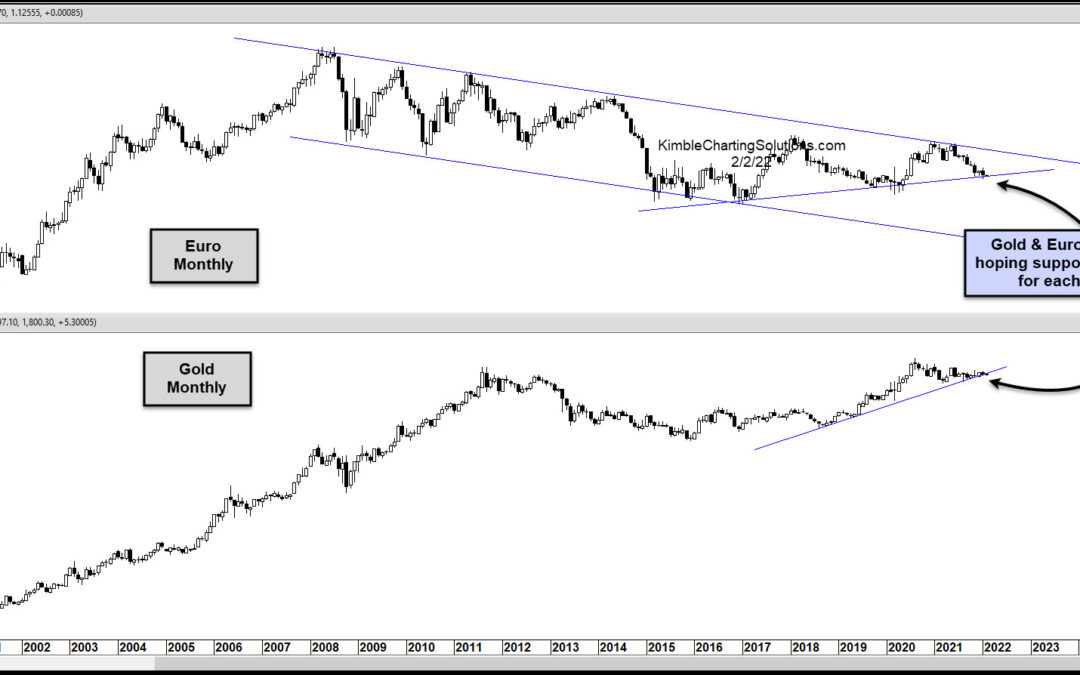

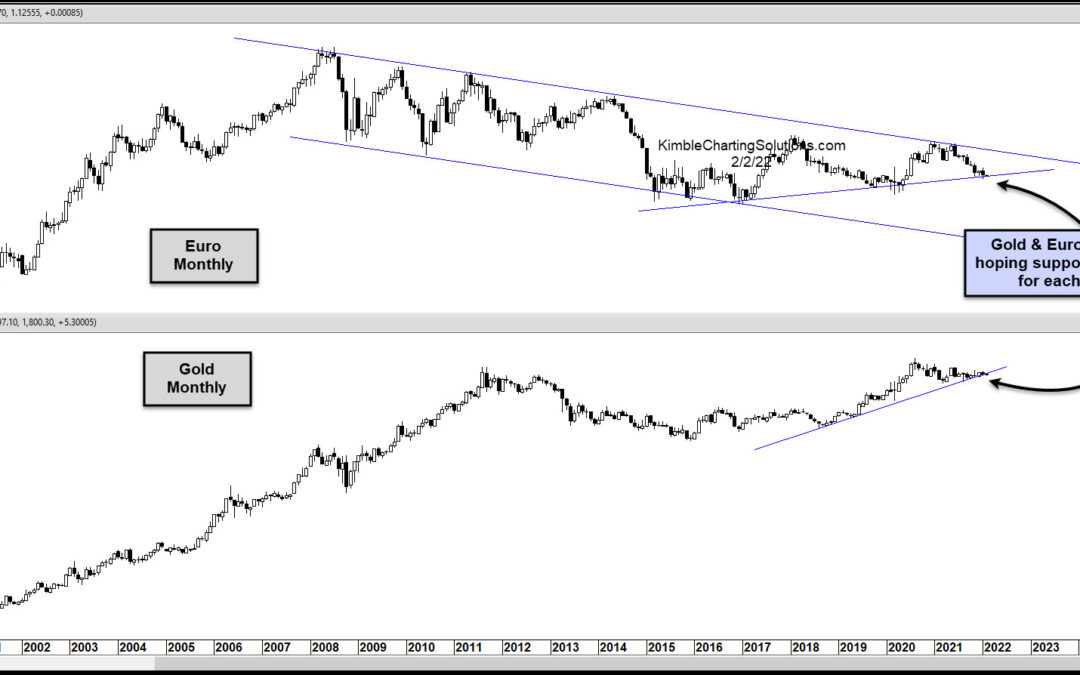

by Chris Kimble | Feb 3, 2022 | Kimble Charting

The price of Gold has been moving sideways-to-lower for months now. But this consolidation is nearing a potential inflection point. Today’s chart 2-pack highlights the long-term relationship between the Euro currency and the price of Gold. And, as you can see, moves...

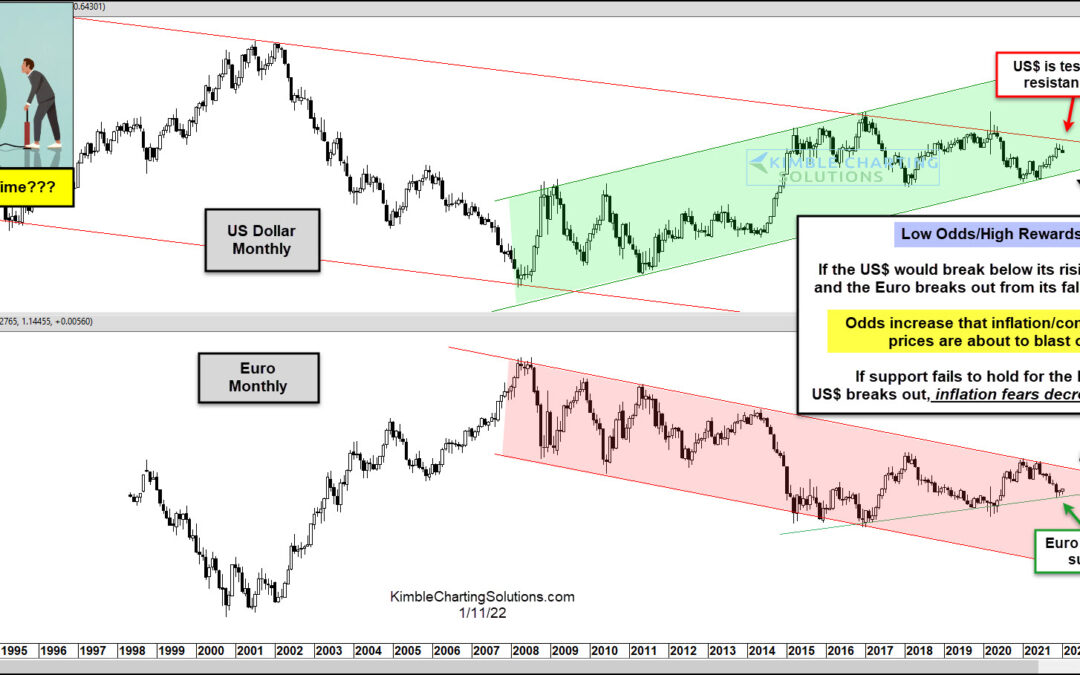

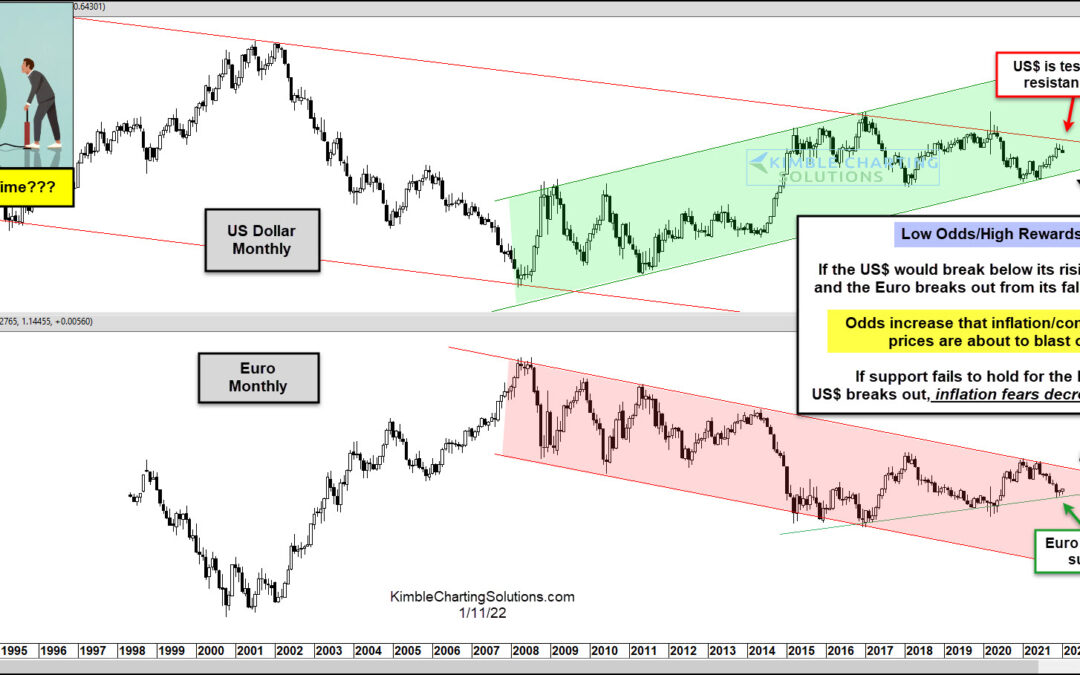

by Chris Kimble | Jan 13, 2022 | Kimble Charting

Current data suggests that inflation has been in our everyday lives for several months. And today’s Producer Price Index data was pretty ugly. BUT… could inflation be peaking? Today’s chart 2-pack offers a glimpse of why inflation could subside over the near-term....

by Chris Kimble | Jan 4, 2022 | Kimble Charting

The recent strengthening in the US Dollar is catching the eyes of traders and investors alike. King Dollar affects so many asset classes, including its own. A stronger US Dollar means a weaker Euro. Today, we look at the recent trading decline of the Euro on a...

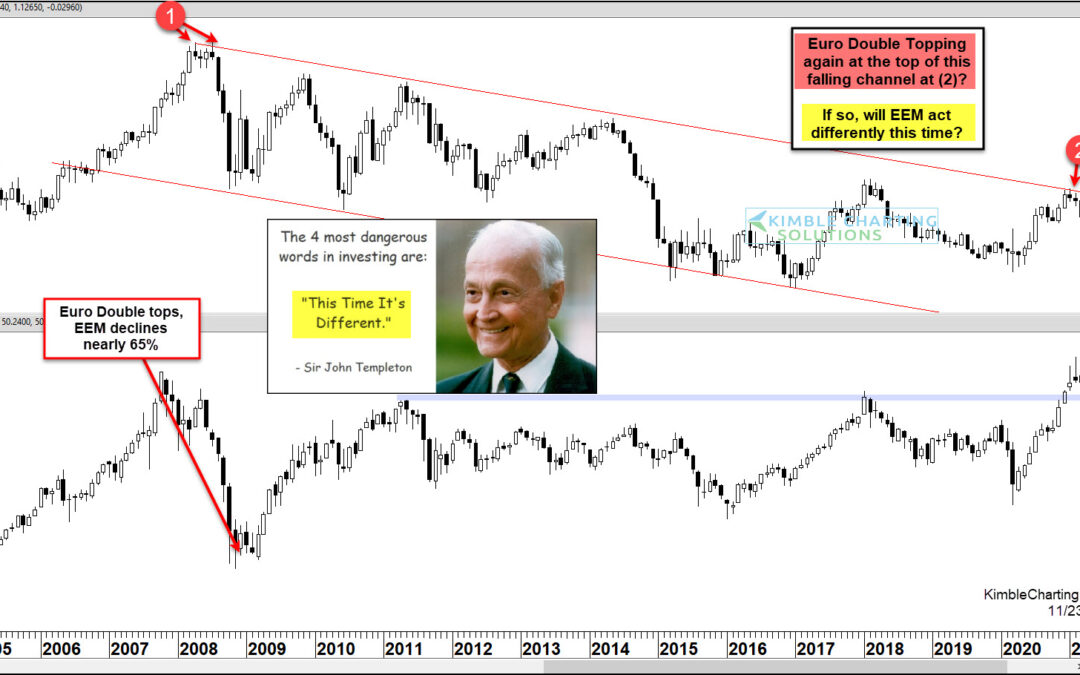

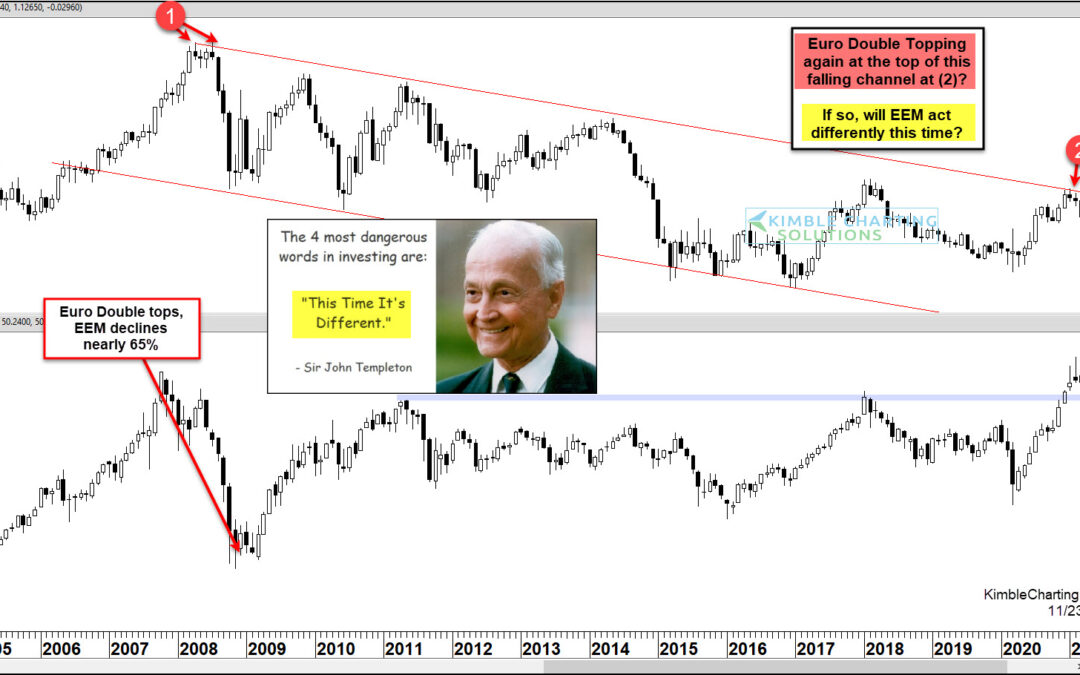

by Chris Kimble | Nov 26, 2021 | Kimble Charting

The Euro currency is sliding and international markets are taking notice. Of course, this is coming as the US Dollar rallies… and all this means pain for the Emerging Markets and its trading ETF (EEM). In today’s chart 2-pack, we compare the Euro to the Emerging...

by Chris Kimble | Nov 1, 2021 | Kimble Charting

The U.S. Dollar and Euro currencies are two of the most-watched in the world, with the U.S. Dollar being the world’s reserve currency. Today’s chart 2-pack highlights a critical inflection point for both currencies. Should King Dollar change course, it would be a big...

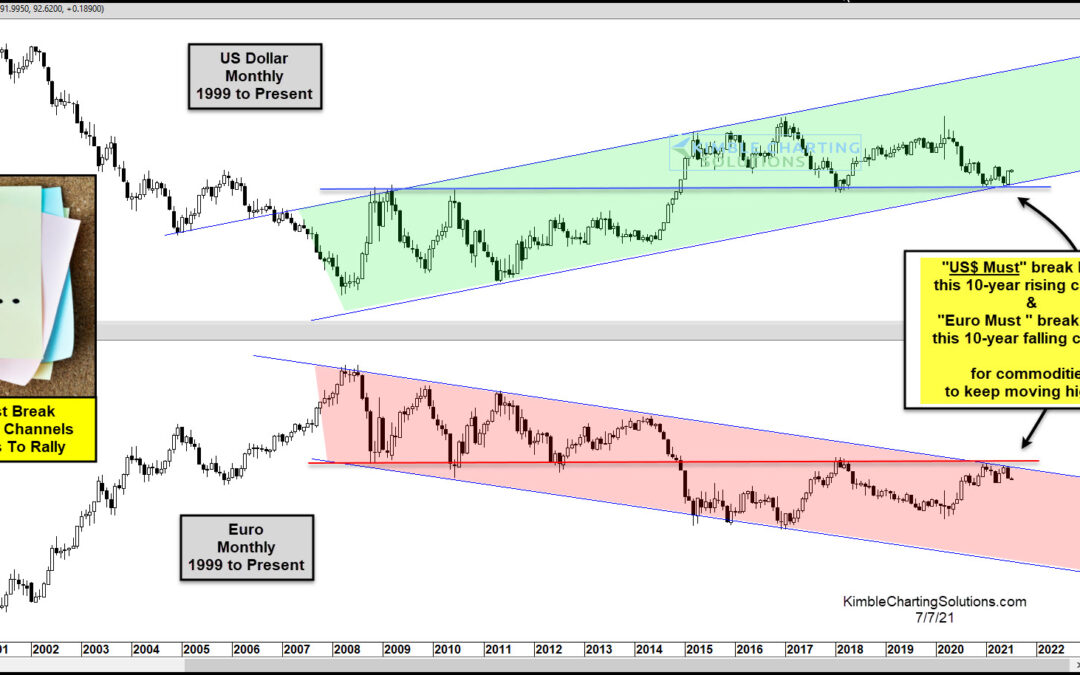

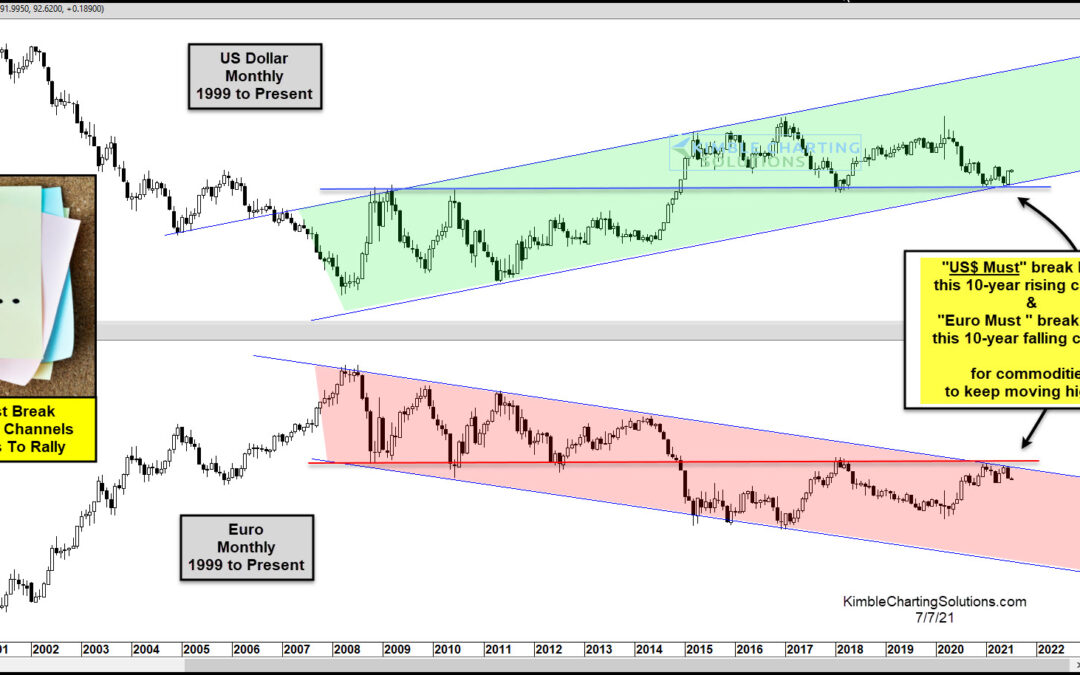

by Chris Kimble | Jul 8, 2021 | Kimble Charting

Inflation pressures are increasing as the economy tries to digest a prolonged period of higher commodity prices. While select commodities have pulled back (and this has investors hopeful that inflation moderates), the broader commodities arena remains elevated. So...