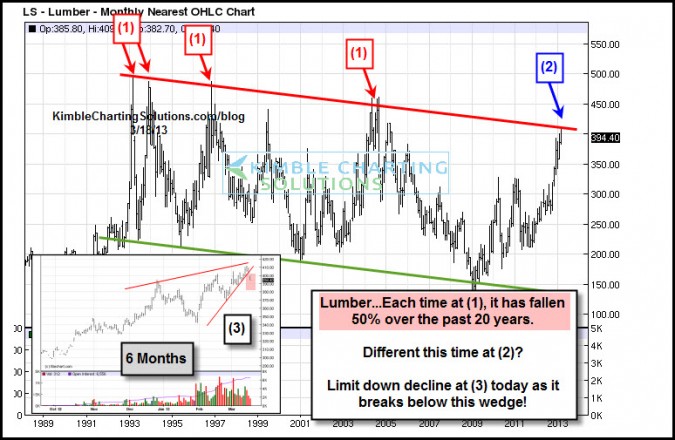

CLICK ON CHART TO ENLARGE

Lumber has traded inside of a channel for the past 20 years.

Each time it has hit the bottom of the channel it has rallied 100% in price. Each time it has hit the top of the channel at (1), it ended up falling 50% in price.

Lumber is now back at the top of this channel, the inset chart (lower left above) reflects a breakdown of a bearish falling wedge. Lumber is limit down today and sentiment is high, over 82% lumber bulls.

Keep a close eye on lumber, because the prior 50% declines happen to be decent leading indicators for the economy and in turn the stock market/S&P 500 declined!

–

–

Innertrader…Thanks for the quality comments and great point about the Dollar and inflation. Speaking of inflation has lumber lost to inflation since it has made NO GAINS in 20-years, peaked that long ago and has made lower highs since? At least Cattle and Gold are higher than 20-years ago. Silver is about half was it was in 1980 right now.

Chris

While Lumber is near the top of the 20 year channel and had a daily reversal a few days ago, plus a gap down on the daily chart; I can certainly see this as yet another trade. However, be careful. Base commodities will eventually break out to the up side, it’s simply a matter of inflation. Where was silver 20 years ago? Where was cattle 20 years ago? One must always keep in mind the dramatic devaluation of the U.S. Dollar! One thing about commodities, they can only go so low… they will never go to zero, like a lot of stocks. Eventually, Lumber will create a NEW 20 year trading range and it will not be lower.

Heya i’m for the primary time here. I came across this board and I find It truly helpful & it helped me out a lot. I hope to give something back and aid others like you aided me.

i don’t think so