CLICK ON CHART TO ENLARGE

Back in the mid-1960’s the popular investment theme was….”buy and hold the “NIFTY 50!” Investors were encouraged to buy & hold 50 quality growth stocks and they would be fine in the years to come! If you bought the Nifty 50 in 1966 what would your portoflio look like by the early 1980’s? Pretty much “Dead Money” and investors would have lost a great deal of capital… plus even more to the high inflation period of the 1970’s!

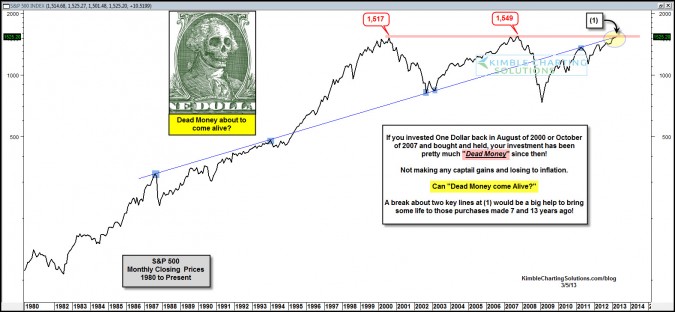

In the late 1990’s the popular investment theme was ….simply buy the low cost S&P 500 ETF (SPY) or the Vanguard 500 index fund and hang on. Just take the idea of the “Nifty 50” and add a zero to it….Buy the “Nifty 500” and you will be fine!

The Nifty 50 ended up being dead money 15 years after the theme became popular and so far the Nifty 500 has been a repeat! The S&P 500 is now at a very important price point at (1) in the chart above, reflecting that a break above these lines could help bring some life to the Nifty 500 buy & hold strategy!

–