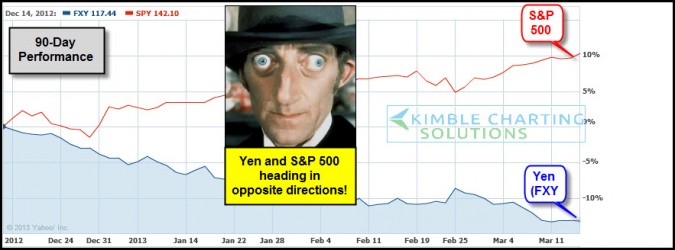

CLICK ON CHART TO ENLARGE

The chart above reflects that the worlds “Least Loved Currency” and the S&P 500 have been moving in opposite directions over the past 90 days. Has this currency helped the S&P 500 rally? It’s possible!

The chart below reflects that hardly anyone loves this currency, with only 13% bulls.

CLICK ON CHART TO ENLARGE

The worlds “Least loved” currency (YEN) finds itself at its 50% Fibonacci price level and the 20% decline since last fall has bullish sentiment setting at 13%. Could this be a set-up for a “short-term counter trend rally” to start from here?

If the Yen does rally, could the opposite take place in the S&P 500? Some goofy things have been taking place over the past few months…Dollar rallies with stocks….so who knows what correlated/non-correlated short-term actions might be in store for investors!

–

–