Could falling lumber prices be sending an important signal about the future direction of the economy and stock market?

Lumber prices over the past 25 years have been a quality leading indicator for the future direction of the economy and the stock market, in both directions.

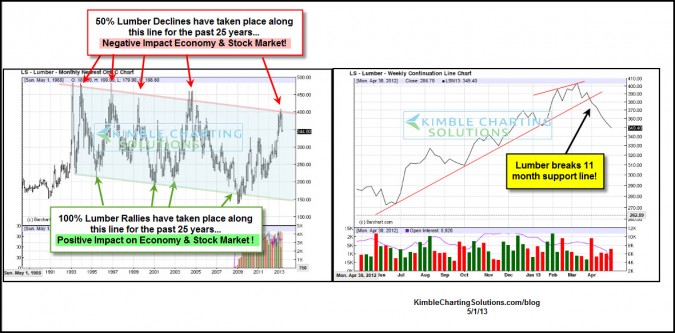

Back in March, the Power of the Pattern pointed out that Lumber was at the top of a 25-year channel (formed a bearish rising wedge), where 50% declines in Lumber often happen in the past…. which was followed by a slowing economy and lower stock prices. (see post here)

CLICK ON CHART TO ENLARGE

This trend/pattern has only happened for the past 25 years!!!

The left chart above reflects a quality channel in Lumber, where 100% rallies have taken place off of support, followed by an improving economy and rising stock market. On the flip side, Lumber has declined 50% after hitting the top of this channel, followed by a slowing economy and lower stock prices.

A few months ago Lumber was at the top of this channel, formed a bearish rising wedge and 75% of investors were bullish. Since that time Lumber has broken an 11-month support line and declined over 10% in price.

Falling lumber prices for the past 25-years has been followed by a slower economy and lower stock prices. Will it be “different this time?” Stay tuned!

–

–