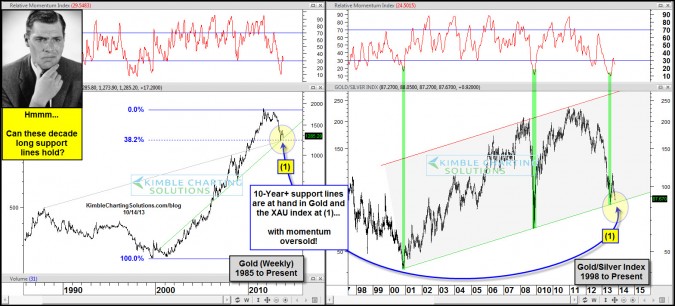

CLICK ON CHART TO ENLARGE

Its been a rough two years for Gold and the Gold/Silver Miners index (XAU), to say the least. Two years ago $GLD not only became the largest “sector” ETF in the world, it also became the largest ETF period! Since the crowded trade developed Gold lost 38% of its 10-year rally in less than 24 months.

Now the 2-year decline has taken Gold and the XAU index down to 10-year+ support lines and momentum is very oversold, reaching levels where rallies have frequently taken place!

Two years ago many investors found it hard to harvest (sell) long metals positions at resistance. (Harvested Gold at $1,900) Wonder if many investors would now find it hard to be a buyer on these 10-year support lines???

Support is support until broken! Metals members that are long-term physical holders of Gold have a specific plan in place should support not hold!

–

–