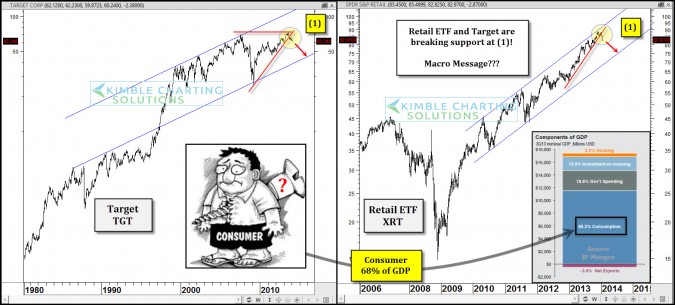

CLICK ON CHART TO ENLARGE

The consumer is very important to the economy in the U.S., as it represents 68% of GDP. From a Power of the Pattern perspective what does this sector look like of late?

One of america’s leading retailers, Target, has been weak of late. Could its weakness be due to its issues with Credit Card theft? Sure! Well then what about the Retail ETF XRT? Both TGT & XRT are breaking support near the top of rising channels.

Could this be nothing more than post Christmas softness? Sure!

Could a slowdown in consumer spending end up impacting the broad market if retail pricing continued to bring down? I will let you be the judge of that. The breaking of rising support near the top of these rising channels should be respected in my humble opinion!!!

–

–