CLICK ON CHART TO ENLARGE

I have a 100% track record when it comes to using the Elliott wave….when I look back in history, I am a great rear view mirror Elliott wave expert. 😉 EW predictions going forward is a different story!

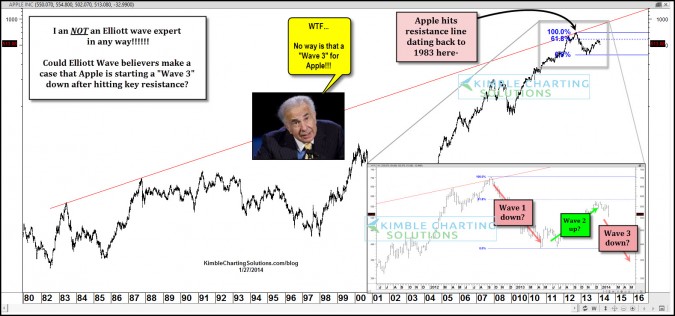

I became aware of Elliott wave in 1980 and have read a few books on the subject over the years. Let me make this clear. I am NO Elliott wave expert in any way!!!!!!! Do I feel it has its good points? Yes Do I feel it has some weak points too? YES!

When Apple was trading around $600 per share, the Power of the Pattern reflected that Apple could be forming a dangerous/bearish Eiffel Tower pattern (See post here) Soon after this post Apple broke support and fell a few hundred dollars per share.

When Apple was trading at $392, the Power of the Pattern suggested a low was near and it should rally! (see post here)

Back to the potential Elliott wave pattern. The decline off the top to the $400 zone, some EW students would say is wave 1 down. The rally off that level to its 61% retracement resistance of late, some EW students would say is wave 2 up.

The next move from an Elliott wave for Apple would be a wave 3 down. Wave 3’s are usually bigger than wave 1! . Again I am not an EW expert in any way, other than looking in the rear view mirror. Months from now it will be interesting to look back and see how Apple and Elliott wave patterns fit or don’t fit at all!

–

–