CLICK ON CHART TO ENLARGE

The yield on the 30-year bond has created a multi-year bearish rising wedge and is breaking lower support of this bearish pattern above, after hitting its 61% Fibonacci retracement level.

CLICK ON CHART TO ENLARGE

The yield on the 10-year note has just experienced its sharpest 18-month rally in 30-years at (2) above and is hitting dual resistance at (1), with very few investors bullish bonds (27% Bond bulls).

CLICK ON CHART TO ENLARGE

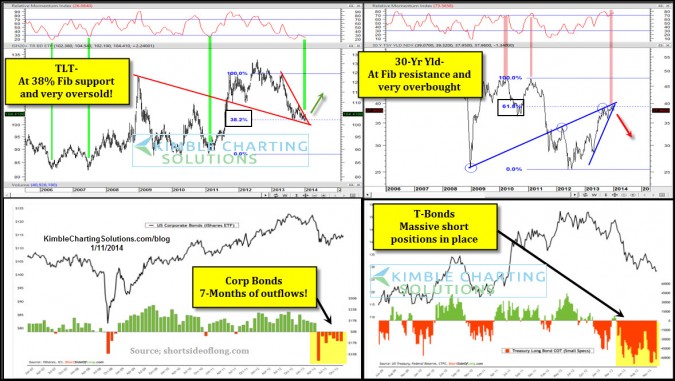

The above 4-pack was sent to premium members a January 11th, reflecting a bullish falling wedge in bonds, a bearish rising wedge in yields, huge outflows and traders establishing a large short position from theshortsideoflong.com

Joe Friday….Two-thirds chance yields fall and bonds rally due to the multi-year rising wedge pattern breaking support above.

–

–