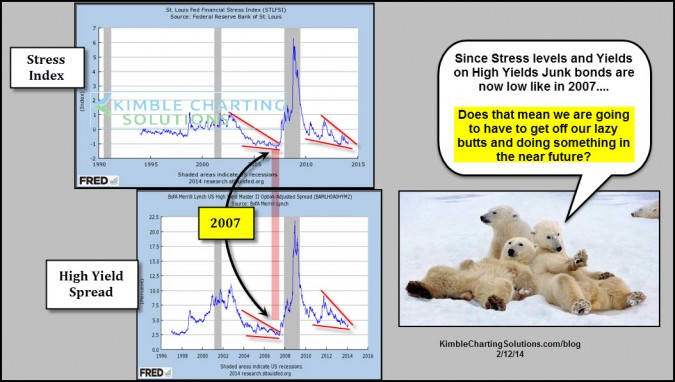

CLICK ON CHART TO ENLARGE

In early 2007 the Fed Stress index was low and the High Yields adjusted spread was very low. Was that good or bad for the markets? When these conditions took place, lazy bears ended up pretty busy.

Now the Stress index & adjusted high yield spread is getting low again, nearing 2007 levels. Will these lazy -ss bears become active again?

Stay tuned to see if these lazy bears get active in the months ahead!

–

–