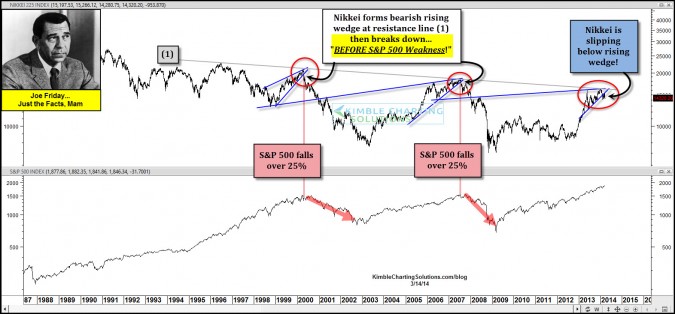

CLICK ON CHART TO ENLARGE

Since 2000, the S&P 500 has declined over 25% twice, each decline had this in common…. These S&P 500 bear markets followed a breakdown of a bearish rising wedge at falling resistance by the Nikkei index.

The Nikkei looks to be slipping below support of a bearish rising wedge and is kissing the underside of the wedge as resistance!

Joe Friday…. The prior two times the Nikkei broke down from this pattern at resistance, in time the S&P 500 followed it! This is not a prediction that the S&P 500 will fall 25% plus! Joe just suggests to keep your eye on this leading index, because continued weakness by the Nikkei, could impact the S&P 500 again!

–

–