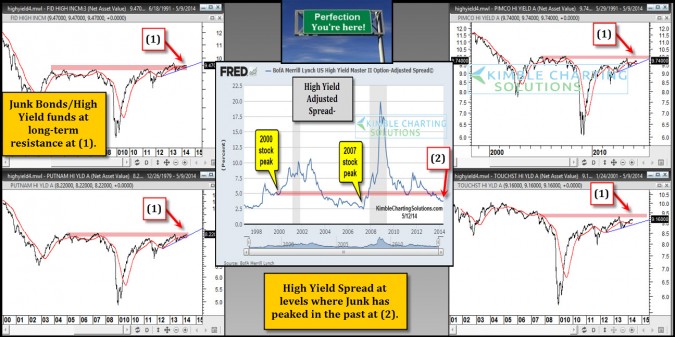

CLICK ON CHART TO ENLARGE

Junk bond mutual funds are now nearing resistance levels at (1), that has kept them from moving higher for the past 10-years. In the past when these resistance lines were hit, it represented a peak for the junk market and stocks peaked around the same time too.

The adjusted spread on the High Yield complex is now near the levels it hit in 2000 & 2007 at (2) above. A level where Junk and stocks peaked in the past. For more details on the Adjusted spread…see here

Is the Junk Bond market priced to perfection? Defaults in this complex has been pretty much zero for the past 18-months, does it get much better than that?

Humbly I feel junk is acting a little too perfect of late…I’m keeping a close eye on them!

–

–