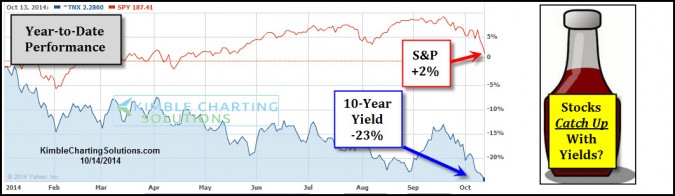

CLICK ON CHART TO ENLARGE

In April, 100% of economists thought interest rates would rise (see here), How is that prediction working out? Joe Friday felt differently, just 90 days ago he thought interest rates would decline another 20%. (see here)

A common theme this year has been….Yields and Stocks have detached, yields are way out of touch. The above chart reflects that the yield on the 10-year note has declined 23% year to date, while stocks are up 2%.

Are stocks about to play a game of “catch up” with yields? The chart below reflects that the yield on the 10-year note is at a very key technical price point!

CLICK ON CHART TO ENLARGE

The yield on the 10-year note finds itself at triple support and its 38% Fibonacci retracement level at the same time. What happens to yields here could have a profound impact on stocks, in either direction.

IMHO, “it’s all about what yields do going forward!”

–

–