CLICK ON CHART TO ENLARGE

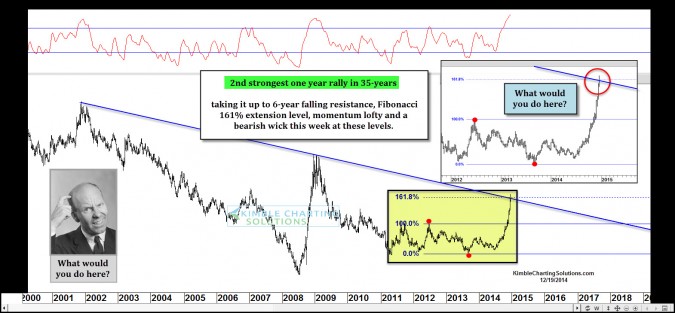

This asset has experienced a big move over the past year, the 2nd largest one year move in several decades.

This assets rally has taken it up to falling resistance that first started in 2000, the move has taken momentum to a level not seen it 15-years and its hitting a Fibonacci 161% Fibonacci extension level, while creating a bearish wick this week at these key levels. Sentiment finds itself at the same levels as 2009, nearly 75% on one side of this trade.

Unusual performance can hatch unusual opportunities. Do you feel in time this could turn into an opportunity? What do you feel should be done here?

We welcome your thoughts/opinions on this situation. If you would like to know the answer to this quiz, we would be happy to let you know what this is and what action we are taking at this time.

Share your thoughts or request the answer to this quiz by sending an email to [email protected] and we will get you the answer as soon as we can.

Have a wonderful weekend, Chris

–

–

Oil & you didn’t put the Pennant formation in

USO & DBO look different because of the cost of futures contracts that are purchased in the ETF

XOP could be another vehicle

I wouldn’t do a thing until a bottom is worked in, The House of Saud had a meeting on Turkeyday, production will be the same & 60 to 40 a barrel is fine with them, in a game of chicken to shut down higher cost producers ie oil sands $ tar, they have done this before with North Sea oil… why catch falling knifes

IYR & VNQ those boring old REITS are performing well coming out of boring Saucer 0r Fulcrum Bottoms

Would sell here but in this crazy market anything can happen. What are you and your members going to do?

Thanks,Joe

Garrett -Thanks for the viewership and this post, I found it of value.

I have found bias to be a personal challenge during my 34 years in the business. I personally have found a way to look at 100+ charts without knowing what that they are, all I see is patterns, no names. This has been an enormous help to me, when attempting to find key turning points. See the rare pattern first, create a plan of action, then find out what it is. I do these charts out of respect and attempted value for the reader. I respect the viewers and I hope if I can find a key turning point and share it, totally based upon a unique pattern opportunity.

I don’t make the patterns, billions of free thinking people do. They create them. I just attempt to share a potential message “they” are sending, hoping it can give all of us a edge in some small way.

Thanks again for your viewership and sharing your thoughts, both are appreciated.

Happy Holidays to you and yours. Chris

short it versus the swing high as your stop is my guess but I would still love to know the answer on which asset this is and what your premium service suggests to do with it? 🙂

Thanks!

Brian

Just found your website a few weeks ago. Would love the answer. From viewing the chart, I would be a seller but not until the bearish wick was confirmed.

This is the crude oil…Inverted! Am I right?

russian index inverted…..

russian Index…. guys…

That looks like the inverted chart of Oil – WTI

-Nathan

If I owned I would be a seller, don’t get greedy. I would then be ready to short or use an inverse ETF. The down side looks much stronger than the upside. Now this may not be the exact top but it looks close. This could be a “looks less bad than” situation. IMHO

Eiffel Tower appearance means it will return to the base whereit all started in a simmetrical time frame

Looks like a parabolic rise to me. I would be selling.

Would also like to know what asset this is and your recommended action.

Something with oil? Eiffel tower pattern? Go short here?

Good morning,

I m still learning how to read charts but I will say I go long for this asset according to the chart.

And of course I would like to know what this asset is and your action.

Thank you.

sell it next year 7 yr cycle

I’d like to get the answer to the quiz.

Thank you!

What is the benefit of making a guessing game out of it?

It almost seem disrespectful to your readers. Today’s world doesn’t allow a great deal of time to play games.

Well Chris, whatever it is I missed out on it! Grrr! Time to become a premium member, I think.

Looks like the dollar index.