When it comes to investing, confidence is big deal. Almost two months ago, during the height of the Ebola scare, I came up with the idea of the CDCC indicator. I wanted to take a look at very different assets that had a ton in common, as they all have something to do with confidence of the average consumer.

I first shared this post in October, when the markets were headed south and the S&P was nearly down 10%. The CDCC indicator was NOT expressing big concerns at the time, even though markets were soft and VIX was heading much higher. (see post here)

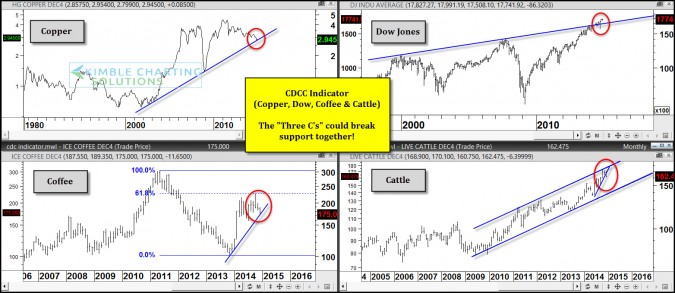

Below is an update to the charts produced on 10/20

CLICK ON CHART TO ENLARGE

This 4-pack reflects the the “3-C’s” (Copper, Cattle & Coffee) could all break support, at the same time, while the Dow remains above the top of its megaphone pattern.

Should each of these three break support, I would suspect investors are reflecting a “lack of confidence” in the macro situation at hand.

Keep a close eye on the “3 C’s” in the near future, they could be sending an important message about the stock market and how investors are feeling!

We all know how another “C” is doing….Crude Oil! Wonder what is it expressing when one thinks of confidence???

–

See our website….Here

–