CLICK ON CHART TO ENLARGE

When it comes to interest rate rallies, Russia tops this list this morning as they raised rates 70% in a day, attempting to stem the rapid decline in the Ruble.

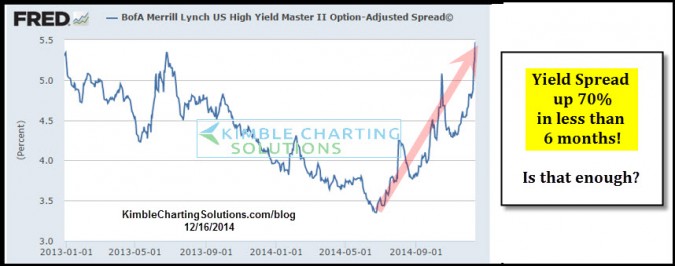

Speaking of interest rate rallies….Did you know the yields on junk bonds are up roughly 70% in the past 6 months? The above chart reflects what has happened to the yields from the junk complex since this summer. (Source St Louis Fed)

Right before the 70% rally in yields, the Power of the Pattern discussed that the “sky could fall” in the junk complex, back in July. (See post here)

Is a 70% rally enough? Is that a sharp rise in rates?

CLICK ON CHART TO ENLARGE

The above chart takes a longer term look at yields on junk bonds. As you can see, during the financial crisis, yields rose almost 1,000% in a couple of years at (1).

The Power of the Pattern 90-days ago shared that the Pimco Junk Bond fund was creating a pattern similar to 2000 & 2007 and its weakness should NOT be dismissed or overlooked! (See post here)

While the world is distracted by the sharp rise in rates in Russia today, don’t overlook the sharp rise in rates in the junk complex and that they could have more to go, which often times sends important signals to stock markets around the world!

What junk bonds, shoe box indicator, Advance/Decline line and the Staples/Discretionary ratio does from here, will send important messages for what investors should do per the percentage of assets that should be at risk!

–

–

See details on our research…..Here

–