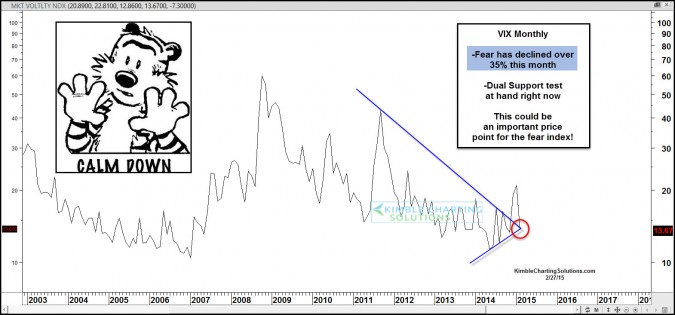

Its been a good month for stocks, as the S&P is up over 5%, one of the stronger February’s in a long time. As you might suspect if the market is up, the fear index is often down. The VIX index is down almost 35% this month.

The chart above looks at the VIX on a monthly closing basis. As you can see above, the VIX is testing dual monthly support going into the close. For those that shorted fear (owned XIV) its been a good month.

What happens at this dual support could be very important per where the VIX is a month from now.

Full Disclosure…Premium Members own XIV and due to the pattern above, have established much tighter stops than normal.

–