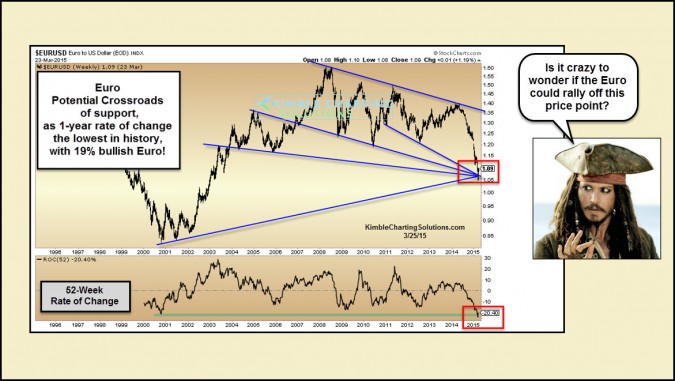

The past year has been rough on the Euro/USD! How rough? The bottom section of the above charts looks at the 52-Week rate of change on the Euro, which reflects the Euro/USD has had the worst one year decline in its history.

The decline has driven the EUR/USD to a potential cluster of support (top red rectangle).

The historical decline in the EUR/USD has had a big impact on sentiment. The chart below from Sentiment Trader, reflects that just 19% of investors are bullish the Euro at this time.

Does it seem crazy to think that the Euro could actually bounce? I can understand if you feel that way, as the trend for sure is lower at this time.

I like this theme…its not the odds of something happening that is key, its the impact if it does. The odds might be low that the Euro rallies, if it does, the impact could be rather big since such extremes are in play.

Should the Euro rally, odds are decent that the metals complex (Gold, Silver and Miners) could be a beneficiary. Stay tuned friends, this could get interesting. Should the Euro rally, it would surprise a good number of investors, as 89% of investors are bullish the US$ at this time (record levels)!

If you would like to receive research on how this situation could be played in the metals complex, click the button below for sign up details-

–