When it comes to investing in the stock market, do you feel leadership can be important. If so, you might want to pay attention to price action from a key global stock index. China has been in the news for hot stock market performance that past couple of months. When it comes to the past couple of years, Germany has been stronger than China and the S&P 500. In the past two years the DAX index has gained 18% more than the S&P 500, which is a 60% greater return.

The chart below looks at conditions in the DAX at this time and what message is coming from this index.

This chart reflects that at the end of last week, the DAX index was up against rising resistance that has been in play since 2012. This week the DAX index is attempting to break a short-term support line with momentum at lofty levels at (1) above. Over the past 5-years, when momentum was this high the DAX struggled to move much higher.

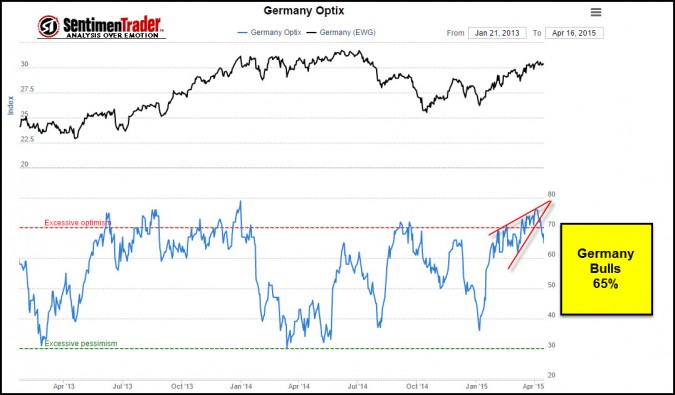

The chart below looks at sentiment for the Germany ETF EWG. Currently 65% of investors are bullish at this time, backing off of late and breaking short term support too.

Fear index has tanked the past 90-days! Investors a tad bit confident???

Joe Friday just the facts…Germany has been a hot performer in 2015 and the past two years. Should weakness start taking place in this leading index, it could create selling pressure in the S&P 500 and in white hot China! These leading index’s are above long-term moving averages and above long-term support lines. Keep a close on the DAX in the weeks to come, what it does from here could well influence the S&P 500 in either direction!

To see more of our research and membership option…Click Button Below ![]()

–