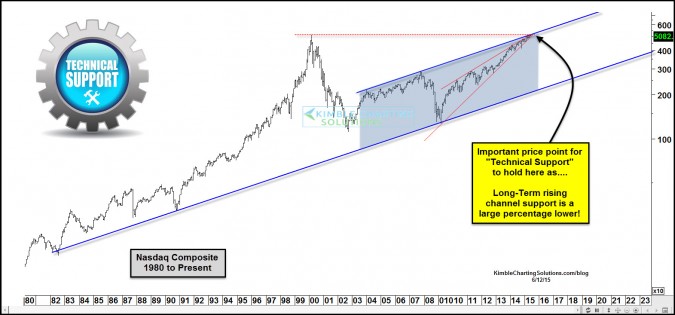

The Nasdaq Composite index finds itself at the same price level as it was at the heights of the dot.com bubble peak. By itself one could view it as a potential resistance line in the sand.

This price point has my attention though even more. Right now the Nasdaq Composite index is at the top of a 12-year rising support channel, with the base of the channel dating all the way back to the early 1980’s.

As it is hitting the top of this rising channel, it is facing a resistance line dating back to the 2010 highs. This line becomes resistance of a rising wedge pattern that is about to end.

Joe Friday just the facts….. The Nasdaq is facing a “Triple resistance test” right now and it appears very important that “Tech Support” holds, as rising channel support is a large percentage below current prices!

Markets are facing “Price and Pattern” resistance levels, none of us have ever seen. If you would like to stay on top of these unique patterns, I would be honored if you were a member.

Click below to find out how to receive research on a Daily or Weekly basis…

–

The nasdaq chart and your comments are much appreciated.I failed to notice this pattern.It’s rather dramatic and possibly important.