Let me start off with this…At this time the trend in the tech space is up! The Nasdaq Composite Index and Nasdaq 100 are both above support lines and long-term moving averages!

Leading tech indices are at prices points where weakness would not be good to see right now.

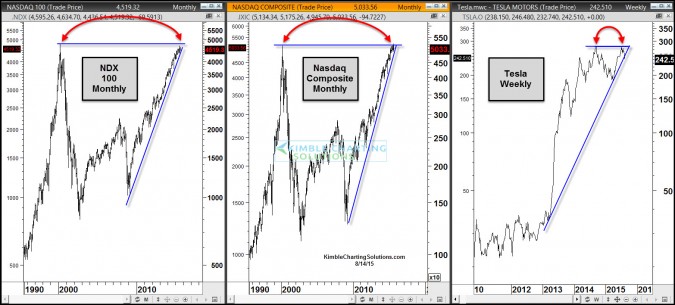

CLICK ON CHART TO ENLARGE

This 3-pack looks at two leading tech indices and Tesla at the same time. The Nasdaq Composite index and NDX 100 are both testing price highs from the Dot.com bubble 15-years ago. Are both creating “Double Tops” 15-years later? With the trend being higher, one has should look at them this way, both are testing breakout levels.

Tesla hit all-time highs last September and then revisited that price of late. Is it creating a double top as well?

Amazon and Netflix are the two leading gainers in the S&P 500 this year. Could they be at important prices points too? Yes they are!

Both of these white hot stocks are attempting breakout levels of 10-year rising channels. As you can see, these channels have impacted both of these stocks several times over the past ten years. Will it be different this time?

As mentioned, trends on all five of these are up at this time, which means each are attempting breakouts.

Joe Friday Just The Facts Comments….This would not be a good place for tech stocks to slip and fall, because it wouldn’t take much of a decline to break very steep rising support lines.

–