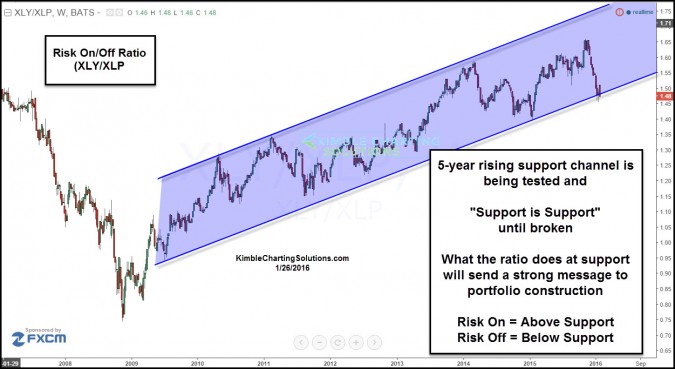

One of the more popular indicators for the “Risk On & Off” trade is the Discretionary/Staples Ratio (XLY/XLP).

When the ratio is moving higher, Discretionary stocks are acting stronger and the message would be; investors should be leaning towards the “Risk On” trade.

The opposite is true too, when the ratio is heading lower, Staples are acting stronger than Discretionary Stocks and the message to investors is; lean to towards the Risk Off trade.

Below looks at this Risk On/Off Ratio

CLICK ON CHART TO ENLARGE

The Risk On/Off ratio has declined sharply of late, no doubt about it. The decline is concerning for the Risk On crowd.

The decline has taken the ratio to 5-year rising support. The pattern looks just like global markets, which are testing 5-year rising support.

90-Day trend is down, 5-year trend is up.

Keep a close eye on the Risk On/Off ratio as is testing key rising support.

Above support = Risk On Trade from a long-term perspective.

Below 5-year support = Negative message for the Risk On Trade!

I humbly feel what the Ratio does at support, will have a large impact on portfolios come summer.

–