CLICK ON CHART TO ENLARGE

On New Years Eve (before global weakness was taking place), the Power of the Pattern warned investors of a “Slipping Hazard” in the Transport index, as it was near a key breakdown, which could ripple into the broad markets. See post HERE.

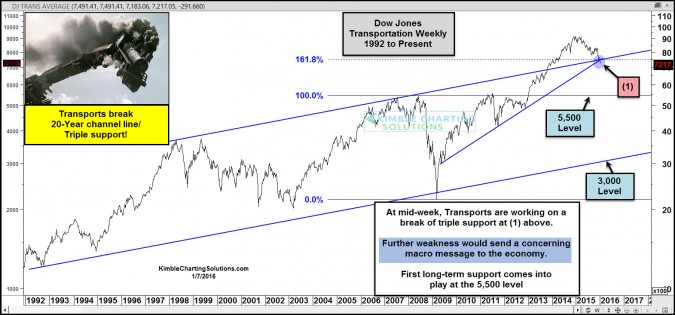

The chart above is an update to last weeks post.

The Transports index is now attempting to break triple support at (1) above.

Continued weakness below triple support, could set off a new round of selling pressure. If selling pressure continues, the first long-term level of support comes into play in around the 5,500 zone.

Full Disclosure- Premium Members are short the Nasdaq (see why here) and S&P 500 with trailing stops in play.

–