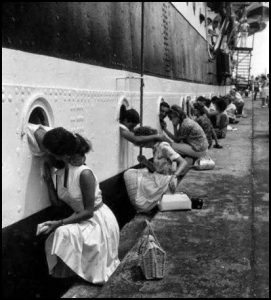

Important Kisses were taking place in the picture above, as some wondered if they would see loved ones again.

Below looks at the Thompson/Reuters Commodity index over the past 60-years and how an “important kiss of resistance” might have taken place.

CLICK ON CHART TO ENLARGE

The TR Commodity index may have created one of the largest topping patterns I have seen in my 36-years of watching charts. The topping pattern may have taken years to form, which is rare for any asset. That is why this pattern could be extremely important from a macro point of view and its outcome could impact stocks on a global basis.

Regardless if our read on the H&S reversal pattern is correct or not, what is taking place now in this space looks to be very important. The commodity index did break below a long-term support line earlier this year and now it is “kissing” the underside of dual resistance at (1) above.

With the worlds central banks attempting to bring life to the global economy, they would NOT want to see resistance hold and continued weakness take place below dual resistance at (1).

Even if you are not interested in investing in commodities, I humbly feel the global risk on trade in stocks, would like to see a more positive message and breakout above resistance at (1). As you are well aware of, stocks have rallies since 2011, while this index has declined sharply. Can this trend just keep on going for years and years?

With central banks pushing rates near the zero level, I am humbly surprised to see commodities still struggling to move higher. With the trend being down for the TR Index since 2011 (lower highs and lower lows), it would be concerning for this space, if resistance held and sellers kept coming forward. If commodities could break above resistance, it would send a risk on message to this sector and stocks could like it as well.