My mentor Sir John Templeton (founder of the Templeton Funds) used to share that the four most dangerous words in investing are; “It’s Different This Time!”

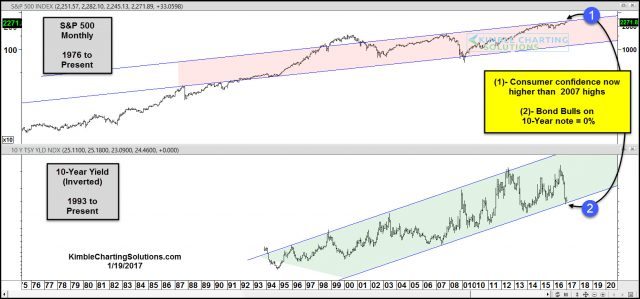

Below looks at long term charts on the S&P 500 and the yield on the 10-year note (inverted to look like bond prices).

CLICK ON CHART TO ENLARGE

The S&P 500 remains inside of a rising channel for the past 15-years. The yield on the 10-year note remains inside of a 15-year rising channel as well. One thing that is for sure different this time, stocks are at the top of the channel and inverted bond yields the polar opposite.

A couple of things are different between the two from a sentiment perspective at this time. As the S&P is testing the top of this long-term rising channel at (1), consumer confidence has just surpassed the highs reached at the 2007 peak. On the flip side, as bonds are testing rising support at (2), bullish sentiment on the 10-year note according to Sentimentrader.com, stands at “0% bulls.”

Will it be different this time, in that stocks can break above its long-term rising channel, with consumer very confident?

Will it be different this time, in that bonds will breakdown from this long-term rising channel with 0% bulls?

Will it be different this time? From a global growth story, it would be cool to see stocks breakout due to growth and yields break support, due to the same thoughts.

Always is fascinating to see and discuss, if it will be different this time!!!