Stocks in the states have done well the past few years and so have stocks in Emerging Markets countries and China

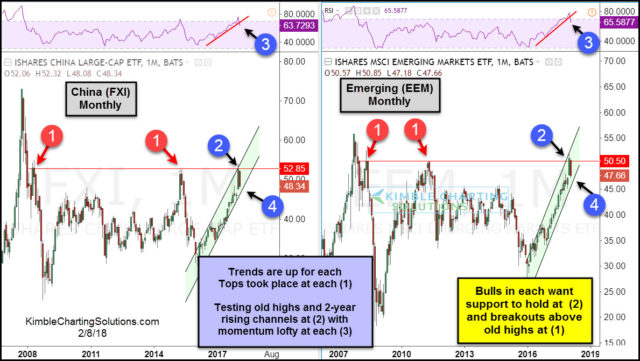

Below looks at popular Emerging Markets ETF (EEM) and China ETF (FXI) over the past 10-years-

CLICK ON CHART TO ENLARGE

EEM & FXI have both done extremely well since the lows of 2016. Both have out performed the broad markets in the states by nearly 50% since the lows in 2016.

The rallies over the past few years now has each testing highs reached two other times over the past 10-years at each (1), reflecting the both are attempting to break free/breakout of prior highs. Both hit the old highs recently at each (2), where they have backed off a little of late. The rallies over the past couple of years has pushed momentum up to levels last seen at the 2008 highs.

Bulls in Emerging markets, China in the states want support to hold at each (4) and breakouts take place above old highs at each (1).