CLICK ON CHART TO ENLARGE

Apple has been rather strong of late. Over the past 30-days, it has rallied over 12%. This gain was twice that of the S&P 500 during the same time frame and nearly 25% more than the NDX 100.

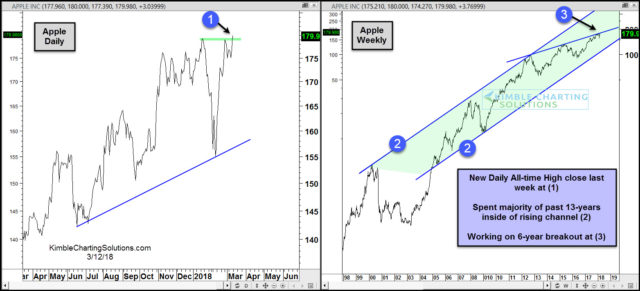

This past week, Apple closed at all-time weekly closing highs. A breakout test is in play in the 2-pack below at (3), that should be very important to Apple and the Nasdaq Composite in the following chart!

CLICK ON CHART TO ENLARGE

The chart on the left highlights that Apple closed at all-time highs this past week at (1). The chart on the right highlights that Apple has spent the majority of the past 13-years inside of rising channel (2). The rally over the past month now has Apple attempting to break out above the line at (3). If it does succeed at this breakout test, it could attract buyers.

Members bought Apple a month ago and if it does break out, we will be looking to add to the position at (3).

As Apple is attempting to break above a 6-year breakout line in the sand, the NASDAQ Composite index is attempting to break out of a 15-year rising channel below.

CLICK ON CHART TO ENLARGE

How Apple handles the breakout attempt at (3) in the prior chart, could highly influence what the Nasdaq Composite does in the chart above!

–

View our most recent webinar multi-decade patterns in play and how to take advantage