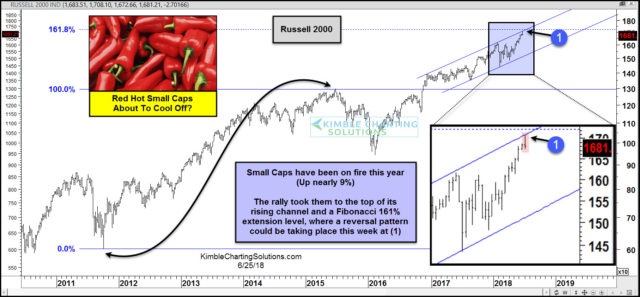

CLICK ON CHART TO ENLARGE

Small Cap Stocks (Russell 2000) have been red hot this year, up over 9%. This gain is 7% more than the S&P 500 and the trend on them remains impressive and is up.

The rally this year has the Russell 2000 testing the top of an 18-month rising channel and its 161% extension level at (1) this past week. While testing this dual resistance last week, this red-hot index might have created a bearish reversal pattern.

Last weeks action did NOT change the trend of small caps. This is one price point where bulls don’t want to see selling by this leader get started.

—