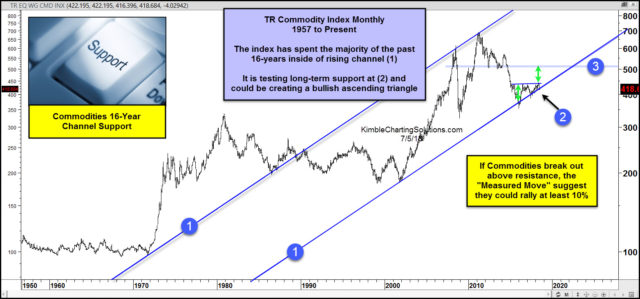

CLICK ON CHART TO ENLARGE

Commodities have spent the majority of the past 16-years inside of rising channel (1). Despite this long-term uptrend that remains in play, they have been declining since they hit the top of this channel back in 2011.

The decline over the past 7-years has the TR Equal weight commodity index testing rising channel support at (2), where it could be creating a bullish ascending triangle pattern (flat tops and rising bottoms).

A very important support test is in play currently. Commodity bulls do not want to see this long-term support channel broken to the downside.

If commodities can rally and breakout at (3), the “Measured Move” suggests they could rally at least 10%.

This index is in a tight jam between rising support and horizontal resistance. Something has to give soon. If its an upside breakout, it would suggest a nice rally for this sector that has struggled for years and investors would want to be on board if it happens.

–