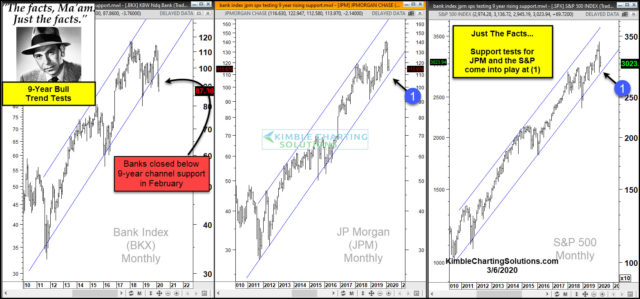

By now you are most likely aware that the S&P 500 just experienced its quickest 10% decline in its history. Did this decline break long-term rising channels? Check out the 3-pack above.

This 3-pack takes a monthly look at the Bank Index (BKX), JP Morgan (JPM) and the S&P 500. Each has spent the majority of the past 9-years inside of rising channels, as they have created higher lows and higher highs.

These channels are important as the 20% decline in the S&P 500 in the fall of 2018 tested rising support, yet it did not break it.

The Bank Index closed below its 9-year rising channel in February, which was a first in the past 9-years.

JPM and the S&P 500 both remain above 9-year rising support at each (1), reflecting the long-term bull trend is still in play.

Joe Friday Just The Facts Ma’am- If the S&P and JPM close on a monthly basis below 9-year rising channels at each (1), the 9-year bull market/trend looks to be in jeopardy.

Investors can either be a follower or fighter of the trend. Long-term investment success often takes place when the long-term trend is correctly identified. If being on the right side of the trend is important to you, our Global Trend Report will be of great assistance in Trend awareness.