What goes up in a down market? Correlation!

This 4-pack looks at patterns of Germany, London, France, and the States. No doubt each has been hit hard in the first quarter of 2020.

All four have experienced counter-trend rallies, where each is facing multi-year support/resistance lines as overhead resistance at each (1). At the same time, each is facing overhead resistance tests, each is near an important Fibonacci retracement level as well.

European stocks have been weaker than the S&P 500 for several years. In my humble opinion, what these relatively weak indices do at each resistance test/Fibonacci level, most likely will send an important message to stocks in Europe and the states.

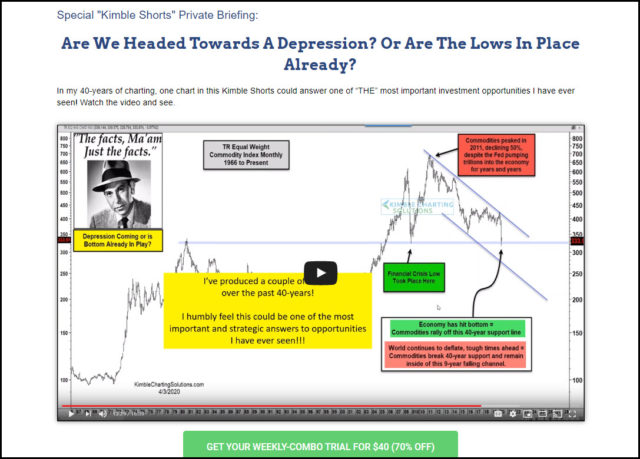

Are we headed towards an economic depression or has the majority been fooled and the lows are already in play?

See our thoughts in this video and how to take advantage of our 40-year anniversary special.