Is our banking system about to send us one of the most important messages in the last two decades? Joe Friday says,”Absolutely yes!!!”

The top chart looks at the Banking index (BKX) over the past 25-years. The 60-65 price zone is represented by line (1).

When line (1) held as support in 1998, 2002, and 2012, Banks and the S&P both bottomed together and experienced very strong rallies for years to come.

When support line (1) broke in 2008, Banks fell an additional 60%+ and the S&P fell 30%+.

Joe Friday Just The Facts Ma’am; Joe humbly does not know if line (1) will hold.

What does Joe know?

If this support line holds at (4), similar to 1998, 2002 and 2016, the odds are high the lows for banks and the S&P are in play and maybe the worst of the virus news is behind us.

If support at (4) is broken by the banking index, look for Banks and the S&P to trade much lower in the future!

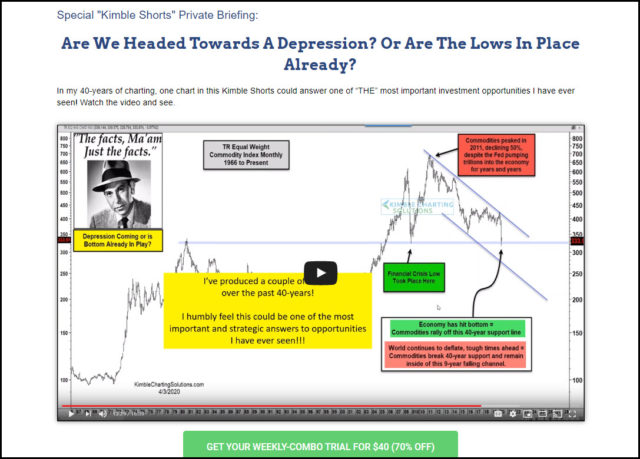

Are we headed towards an economic depression or has the majority been fooled and the lows are already in play?

See our thoughts in this video and how to take advantage of our 40-year anniversary special.