The US Dollar sell-off and subsequent rallies in the Euro and Aussie Dollar have given commodity bulls reason to watch the forex and be hopefull.

A weak Dollar (and strong Euro / Aussie) tends to be a tailwind for commodity prices.

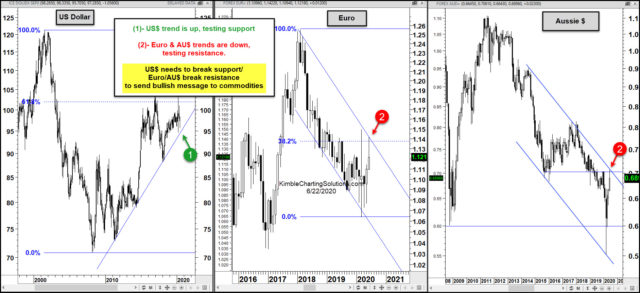

As you can see in today’s chart, the US Dollar is in a trading up-trend. But King Dollar is struggling to get over its 61.8% Fibonacci level. In fact, the latest decline has come from this level.

The Dollar is now nearing up-trend support at (1). This comes as the Euro and Aussie are testing important resistance levels at (2).

A Dollar breakdown (and Euro / Aussie breakouts) would be a bullish signal for commodities… from precious metals to energy to agriculture. Stay tuned!

This article was first published at See It Markets.com. To see the original post CLICK HERE.