Technology is at the heart of our economy… the same way that industrials were 100 years ago.

And that leadership has been present in the stock market for the past two decades. Today’s chart illustrates this… as well as a potential “pause” in that leadership vacuum.

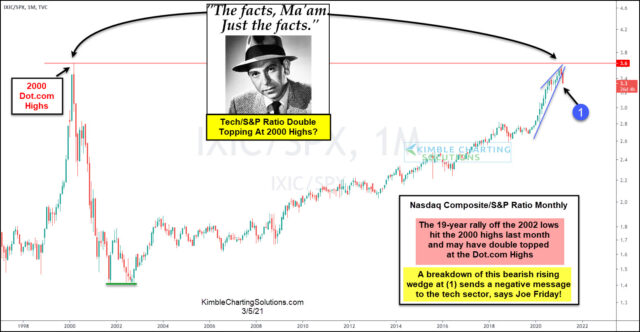

Below is a long-term “monthly” ratio chart of the Nasdaq Composite versus the S&P 500 Index. Here you can see how technology stocks have led the broader market for the past 19 years!

BUT the performance ratio recently tested its 2000 highs last month and turned lower.

Here Joe Friday asks, “potential double top at 2000 highs?”

Perhaps… at a minumum this is strong resistance that is producing a bearish reaction for tech stocks.

Joe Friday Just The Facts Ma’am, Should the index breakdown from this rising wedge pattern at (1) at the end of the month, it would be sending a negative message to the tech sector. Stay tuned!

This article was first written for See It Markets.com. To see the original post CLICK HERE.