The health of the global economy relies on several key factors, but one of the more important ones is shipping.

And the Baltic Dry Index (BDI) is a solid barometer for economic activity.

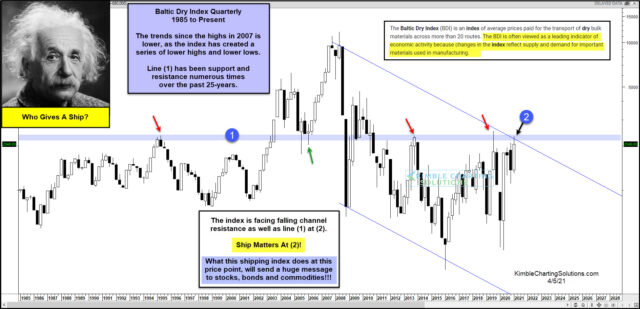

BDI is an index of average prices paid for the transport of dry bulk materials across more than 20 shipping routes.

Today’s chart is a long-term “quarterly” chart of BDI. Notably, trends have been lower since peaking in 2007. But BDI has been rising over the past 5 years and is now testing dual breakout resistance at (2). This resistance comprises of the falling upper channel line, as well as an important 25-year price resistance and support line marked by (1).

Who gives a ship? Well, investors in stocks, bonds, and commodities should! Stay tuned!

This article was first written for See It Markets.com. To see the original post CLICK HERE.