Elevated steel prices have consumers (and investors) concerned about inflation. And whether inflation strengthens or lightens up may depend on the next move in steel prices.

After a huge rally out of the coronavirus crash low, steel prices peaked this summer but have been in consolidation mode ever since.

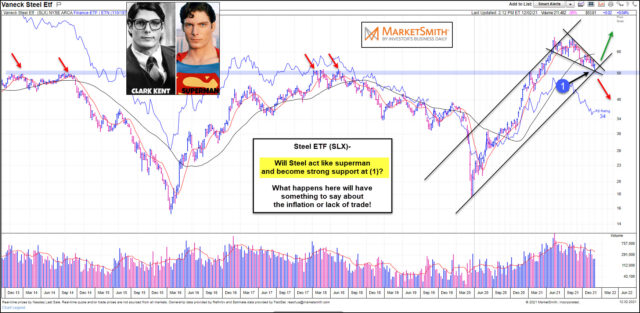

As you can see in the chart above, the Steel ETF (SLX) has been narrowing of late and may soon break higher or lower.

Bulls are hoping the blue breakout line (that once was resistance) now holds as support. And all this may soon be coming to a head at (1).

What SLX does next should provide a clue to the next big move in inflation or lack of inflation for a while. Will steel act like Superman and head higher once more?

If SLX breaks out to the upside, look for it to challenge its old highs around $67, which is a large percent above current levels!

This article was first written for See It Markets.com. To see the original post CLICK HERE.